In the current landscape, trailer orders struggle to meet historical averages, marking a crossroads for the trucking industry. In August, only 7,261 trailer orders were recorded—10,000 units below the ten-year average of 17,568 units. This decline highlights broader economic anxieties impacting the market. Post-Labor Day, spot market rates fell, wiping out pre-holiday gains, further straining an already pressured sector. Carrier profitability margins hover uncomfortably close to levels seen during the 2008 recession. This article explores the complex web of economic trends affecting trailer orders and the spot market, examining implications for industry stakeholders and the road ahead.

August Trailer Orders

August trailer orders were recorded at 7,261 units, a striking 10,000 units below the 10-year average of 17,568 units. This significant shortfall illustrates the challenges currently faced by the trailer manufacturing sector, reflecting a growing hesitance among carriers towards new equipment acquisitions. Comparing this data, August’s figures saw a 4% decrease from July but an upward tick of 3% compared to the same month last year, resulting in a year-to-date net order total of 109,800 units which is approximately 23% higher than this period in 2024.

Despite this cumulative improvement year-to-date, the drop in August orders raises concerns about the long-term sustainability of the recovery in this sector. Strong economic headwinds continue to challenge the industry, including rising material costs due to tariffs, regulatory uncertainties related to emissions standards, and ongoing weaknesses in the freight market. Carriers are reportedly postponing fleet expansions and equipment upgrades amidst these pressures, which could lead to increased maintenance costs and operational inefficiencies in the long run.

The implications of such low order volumes are profound, as manufacturers grapple with balancing production against a shrinking backlog, forcing operational re-evaluations. Industry experts, including analysts at ACT Research, caution that without a significant uptick in new orders, the trajectory of recovery may stall as we head into 2026. Necessitating a keen watch over market signals will be paramount to gauge the potential for a rebound in upcoming months.

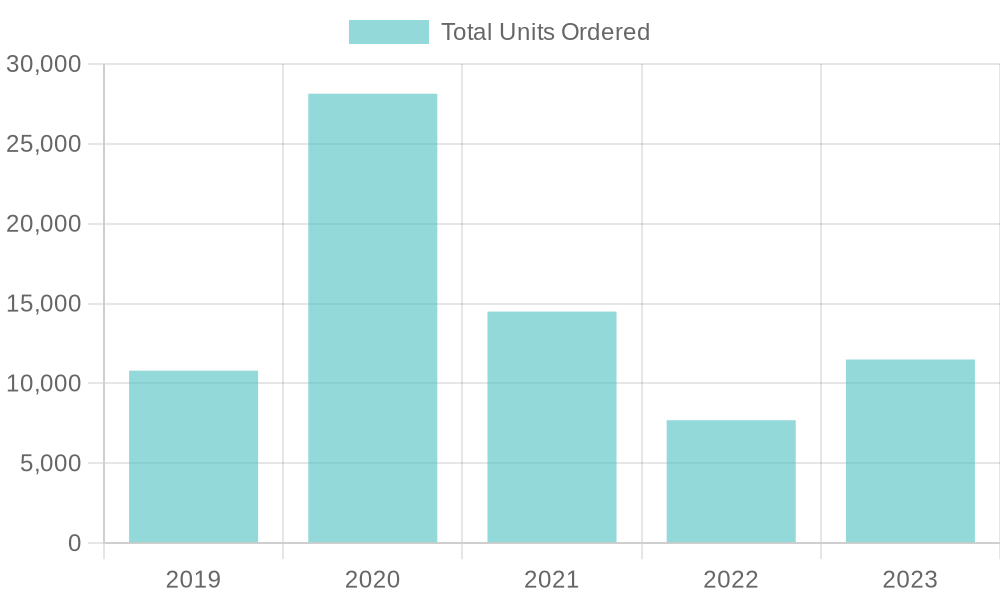

Comparison of August Trailer Orders Over the Last Five Years

| Year | Total Units Ordered | Significant Market Impacts |

|---|---|---|

| 2019 | 10,800 | Market experienced a downturn due to economic uncertainties. |

| 2020 | 28,139 | Orders surged by 49% from July, indicating a strong recovery from earlier declines. |

| 2021 | 14,500 | Orders declined by 35% year-over-year, reflecting supply chain disruptions and material shortages. |

| 2022 | 7,700 | Orders fell 40% year-over-year, marking the fourth consecutive month of decline amid weak freight demand. |

| 2023 | 11,500 | Orders decreased 35% year-over-year, with ongoing declines observed each month of 2023. |

Sources:

U.S. Trailer Orders in August (2019-2023).

Labor Day Impact on Spot Market

Labor Day has historically impacted the trucking industry’s spot market rates, with significant declines often observed following the holiday. The typical pre-Labor Day rush induces heightened demand as shippers seek to transport goods before the holiday weekend, leading to inflated freight rates. However, this spike in demand is frequently followed by a stark decline in both load postings and rates as the industry adjusts to a post-holiday landscape.

Decline in Spot Rates

After the holiday, the spot market frequently experiences a drop in activity. For example, during the week ending September 6, 2025, overall spot rates on the Truckstop load board were approximately 4% lower than the same period in 2023. This decrease can largely be attributed to reduced load postings, which often diminish after Labor Day. The first full shipping week following the holiday on September 8, 2025, saw a notable 11% increase in truck postings, corresponding with a 3-cent decline in the national average spot rates across all equipment types.

Equipment Type Variations

The impact of Labor Day also varies across different segments of the market. Flatbed loads presented an interesting anomaly; during the week ending September 8, 2025, flatbed spot rates grew by nearly 5 cents, breaking a continuous decline since May. In contrast, refrigerated spot rates experienced their most significant decline for that week in recent memory, reinforcing the notion of varied market reactions depending on the freight type.

This duality in market response underlines the complexities of the spot rate dynamics and signals the need for careful monitoring of market trends, especially as we transition through seasonal peaks and troughs.

Conclusion

Overall, Labor Day serves as a pivotal moment for the trucking spot market, indicating shifting trends and highlighting the importance of positioning and awareness within the industry.

Year-over-Year Comparison

The year-over-year data for trailer orders reveals a subtle yet informative shift in the market dynamics, indicating a 3% increase compared to the previous year. While this may appear as a modest gain, it underscores underlying trends in market demand and the broader economic climate.

The increase in orders suggests that carriers are gradually regaining confidence, potentially indicating a stabilization in freight volumes, albeit amidst a backdrop of economic uncertainty. Economic indicators, including employment rates and consumer spending, play a critical role in shaping this demand. A higher number of orders generally points to expectations of increased freight activity, signaling that carriers anticipate a positive adjustment in shipping needs.

However, the context of this increase must also be considered. Despite the year-over-year improvement, overall trailer orders remain well below the historical averages, which raises concerns about the long-term sustainability of this uptick. Analysts caution that while the 3% rise is a positive sign, it does not yet reflect robust growth but rather a slow recovery influenced by cautious optimism in the market. The headwinds posed by rising material costs and regulatory pressures continue to loom, potentially curtailing any rapid rebound.

Furthermore, the marked decline in cancellations from 39% in May to 16% in August suggests increasing confidence among manufacturers and carriers alike, as economic pressures appear to ease, albeit tentatively. This evolving landscape sets the stage for ongoing observation, as how these factors play out against fluctuating economic conditions will ultimately influence future growth trajectories in the trailer manufacturing sector.

An illustration depicting economic struggles within the shipping and trucking industry, highlighting challenges such as low trailer orders and spot market fluctuations.

Key Quotes from Industry Experts

The perspectives of Dan Moyer, Jennifer McNealy, and Ken Vieth provide critical insights into the current challenges facing the trucking industry and the economic trends affecting trailer orders:

Dan Moyer:

Moyer underscores the production challenges for OEMs, remarking, “With builds continuing to outpace new orders, OEMs face mounting pressure to balance production against a thinning pipeline.” This highlights the potential inefficiencies and overproduction risks facing manufacturers, suggesting a need for careful management of inventory and order balances to avoid operational pitfalls.

Jennifer McNealy:

McNealy adds to this sentiment, noting, “Simply put, there isn’t enough impetus in the current hesitant environment to support a more robust outlook.” Her analysis points to a broader lack of confidence in the market, significantly shaped by weak carrier profits and diminishing investment in new assets.

Ken Vieth:

Vieth discusses the implications of current inventory levels, stating, “Vocational inventories are just off record levels, and backlogs are currently at five-year lows.” This observation reflects the supply overhang that has developed, indicating a potential slowdown in production if order activity does not improve soon.

Together, these expert insights paint a cautious picture of the trucking landscape, where economic uncertainties and shifting market dynamics are shaping future trends in trailer orders.

Conclusion

The analysis of the current economic landscape reveals significant interconnections between trailer orders and spot market performance within the trucking industry. As highlighted, August’s trailer orders underscored a concerning trend, with levels significantly below historical averages. This weak demand for new trailers not only reflects a cautious approach from carriers but also signals broader economic anxieties, which are further exacerbated by rising material costs and regulatory uncertainties.

Moreover, the post-Labor Day decline in spot market rates paints a stark picture of the challenges facing the industry. The relationship between trailer orders and spot market performance becomes evident as lower order volumes lead to decreased confidence in market stability, creating a cycle of apprehension among carriers regarding fleet expansion and investment.

As articulated by Bob Costello, Chief Economist of the American Trucking Associations, “I think we are going to get back to normal, and things are going to get better. It’s not going to be the pandemic boom, but we are absolutely moving in the right direction.”

This notion of cautious optimism resonates within the industry, emphasizing a need for resilience and adaptive strategies.

Looking ahead, the potential for recovery rests heavily on several factors, including economic indicators such as consumer spending and employment rates. If these indicators show improvement, we might expect an eventual rebound in trailer orders, which would positively influence spot market rates and profitability for carriers. However, without a decisive shift in these underlying economic conditions, the trucking industry may continue to navigate a landscape marked by volatility and uncertainty. The need for vigilance in monitoring these metrics will be crucial for industry stakeholders aiming to position themselves effectively for future demand fluctuations.

Decrease in Cancellations

In 2025, the U.S. trailer market observed a significant decline in order cancellations, dropping from 39% in May to just 16% in August. This shift indicates a growing confidence among carriers and manufacturers in the market’s potential for recovery. While this decrease is promising, it does not yet signal a robust rebound but rather a cautious optimism amid a still challenging economic landscape.

Significance of the Decline

The substantial reduction in cancellation rates suggests that fleets have begun to stabilize their purchasing strategies, moving towards more predictable order patterns. In May, high cancellation rates reflected a reluctance to commit to new acquisitions due to economic uncertainty and rising production costs influenced by tariffs. As cancellation rates fell, it appears that carriers are starting to invest in their fleets again, albeit cautiously.

Market Recovery Implications

The decline in cancellations coupled with a marginal rise in new orders offers a dual perspective on the market’s health. The fact that August’s new orders represented a slight improvement year over year shows that demand is beginning to respond positively to economic forces, even if overall volume remains below historical averages.

However, external factors such as ongoing economic pressures, fluctuating freight rates, and high interest rates continue to pose challenges. The industry must navigate these complexities as it strives for more sustainable recovery. Thus, while the drop in cancellations is a positive trend, the road ahead requires careful observation of market dynamics to ensure continued growth in trailer orders.

The current profitability margins of carriers are alarmingly similar to levels witnessed during the 2008 recession, reflecting a precarious balance in the trucking industry. In recent quarters, profitability margins have been squeezed due to a combination of factors, including rising fuel costs, increased labor expenses, and fluctuating demand in the freight market. With such pressures, carriers are facing challenges in maintaining sustainable margins, leading to potential long-term ramifications for the industry’s health.

Comparisons to 2008 serve as a stark reminder of how quickly an economic downturn can escalate when margins tighten significantly. This scenario portends a cautious outlook for the future; if these profit levels persist, we could see a reduction in investment in fleet expansion and upgrades, thereby limiting operational efficiencies and innovation in service delivery.

Moreover, weak profitability could further strain relationships with shippers, as carriers struggle to provide competitive rates. The implications of low margins create a cycle of uncertainty that the industry must urgently address to avoid falling into a prolonged downturn that could stifle growth and competitiveness in the coming years.

Key Sources and Citations

For deeper insights into the economic trends affecting trailer orders and the spot market, please refer to the following credible sources:

- Economic trucking trends: Trailer orders remain weak, spot market wipes out pre-Labor Day gains – Truck News

- August 2025 Trailer Orders Remain Below Average | Commercial Carrier Journal

- US Trailer Orders Hit Four Months of Year-Over-Year Gains – TT

- Truckload freight volumes expected to bounce back in 2025 – ATA

- Germany’s industrial orders unexpectedly slip for 4th straight month

Summary of Economic Challenges in the Trucking Industry

| Economic Challenge | Description |

|---|---|

| Low Trailer Orders | August’s orders at 7,261 units are significantly below the 10-year average of 17,568 units. |

| Shrinking Profit Margins | Carrier profitability margins are now comparable to those during the 2008 recession, indicating distress. |

| Rising Material Costs | Increased production costs driven by tariffs and supply chain issues are affecting profitability. |

| Regulatory Pressures | Uncertainties around emissions standards may hinder operational decisions and fleet expansions. |

| Market Volatility | Fluctuating spot market rates post-Labor Day create instability affecting revenue projections. |

| Equipment Upgrades Delays | Carriers are postponing fleet expansion due to economic anxiety and uncertain demand conditions. |

This table summarizes the primary economic challenges faced by the trucking industry, offering a clearer understanding of the obstacles impacting trailer orders and carrier profitability.