The trucking industry is currently grappling with an array of economic challenges that have significantly reshaped its landscape. As freight markets face increased volatility due to fluctuating demands, the margins for truckload carriers are being squeezed tighter than ever.

A telltale sign of this turbulence is the recent decline in trailer orders, which dropped to a staggering 7,261 units in August—10,000 units below the 10-year average for that month. This drop not only highlights the immediate impacts of cautious fleet investment but underscores broader market dynamics that have left many carriers slowing down their growth plans.

With these developments, industry leaders must navigate a cautiously optimistic path amidst emerging uncertainties, driving focus on a reassessment of strategies to maintain profitability and sustainability in the face of shifting economic tides.

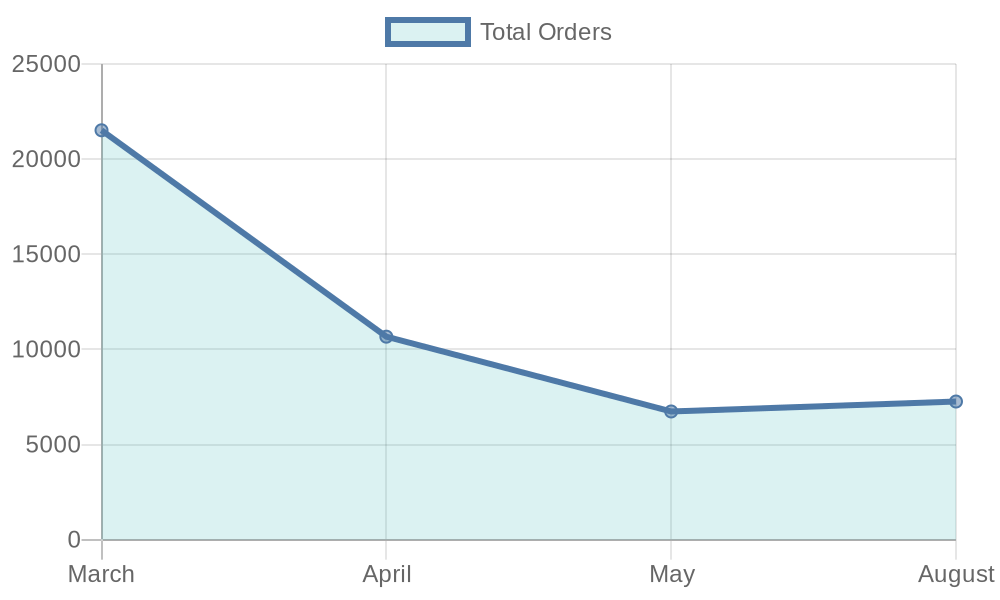

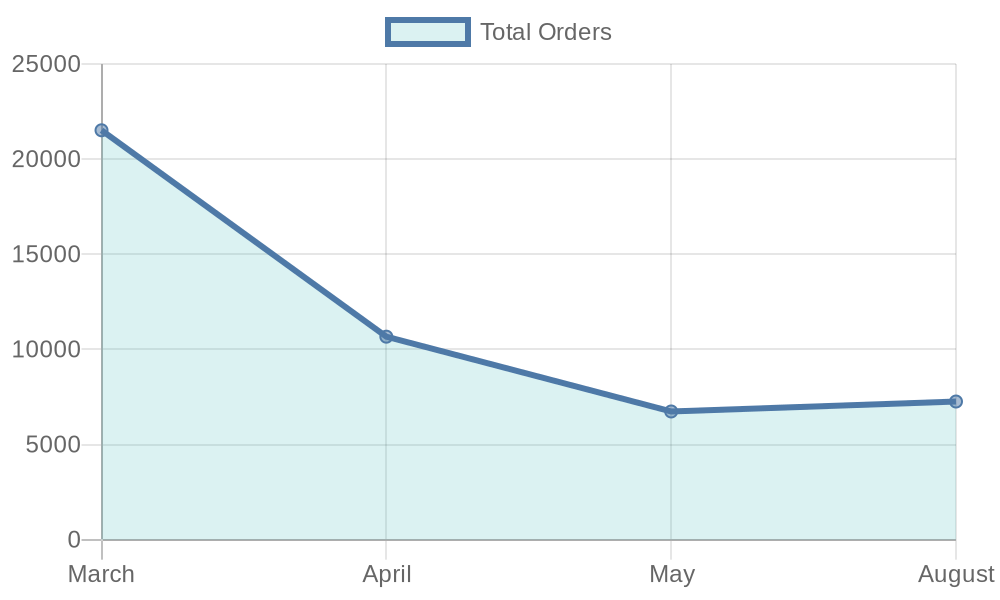

U.S. Trucking Industry Trailer Orders – August 2023

In August 2023, trailer orders in the U.S. trucking industry faced a significant downturn, totaling only 7,261 units, which is 10,000 units below the 10-year average of 17,568 units for that month. This decline can be attributed to various factors:

- Economic Uncertainty and Tariffs: Ongoing trade tensions and tariff volatility have resulted in increased operational costs and marketplace unpredictability, prompting trucking fleets to proceed with caution in placing new trailer orders.

- Weak Freight Demand: A sluggish freight market marked by lower volumes and rates has reduced the necessity for additional trailers among carriers.

- Elevated Cancellations: The industry has experienced a higher-than-normal rate of cancellations, remaining above 30% for four consecutive months leading into August.

Despite the August decline, there were some contrasting trends. Orders were down 4% from July but up 3% year-over-year. Moreover, the year-to-date net order total reached 109,800 units, reflecting a 23% improvement compared to the same period in 2024.

These statistics highlight persistent economic challenges affecting the trucking sector, indicating a rigorous environment for fleet expansion while maintaining careful strategy navigation to sustain profitability amid shifting market conditions.

| Month | Total Orders | MoM Change | YoY Change |

|---|---|---|---|

| March | 21,516 | +3% | +70% |

| April | 10,669 | -50% | -23% |

| May | 6,738 | -34% | +3% |

| August | 7,261 | -4% | +3% |

Notes:

- Data reflects fluctuations in trailer orders as the trucking industry faces ongoing economic challenges.

Sources:

Overview of Economic Trends Affecting the Trucking Industry

The U.S. trucking industry is currently navigating through challenging economic waters significantly influenced by inflation, interest rates, and fluctuations in freight rates. These trends are reshaping the operational landscape for truckload carriers, impacting their margins and overall demand.

Inflation Impact

As inflation continues to rise, operational costs within the trucking sector are also experiencing notable increases. For example, diesel fuel prices have surged over 30% since early 2022, representing a critical expense for trucking operations. The costs for new trucks and trailers have also escalated significantly, with equipment prices soaring by 20-40% over the past 18 months. Such increases result in tighter profit margins for carriers as they grapple with the dual burden of rising costs and declining revenues.

Furthermore, the competition for freight has intensified. With inflation eroding consumer purchasing power, the demand for goods has softened, leading to lower freight volumes. This situation deepens the competition among trucking firms, further driving down freight rates and squeezing margins. Analysts predict that while freight volumes may rise modestly by about 1% in 2025, the current economic uncertainty will continue to complicate recovery efforts.

Interest Rates

Higher interest rates, initiated to control inflation, have also played a role in shaping trucking dynamics. Elevated interest rates have curbed consumer spending and slowed industrial output, leading to reduced demand for freight services. Forecasts indicate that these rates, in conjunction with inflation, might lead to a more prolonged period of cautious freight demand.

Additionally, the burden of higher borrowing costs impacts trucking companies directly, as they may curtail investments in fleet expansion and maintenance due to increased financing expenses. This conservative approach towards capital investments feeds back into the freight market, where capacity constraints can lead to increased volatility in rates and service availability.

Freight Rate Fluctuations

Freight rates have exhibited variability influenced by tariffs, trade policies, and changing market conditions. A recent spike in cross-border trucking rates was triggered by new tariffs implemented on imports, as carriers rushed to mitigate costs, although many of these effects have since leveled out. Predictions suggest a potential adjustment upward in freight rates as demand strengthens in the latter half of 2025, but this recovery is contingent on broader economic stability and improvements in consumer confidence.

Summary

In summary, the interconnected impacts of inflation and interest rates are exerting downward pressure on truckload margins, while freight rate fluctuations add layers of complexity for trucking firms attempting to navigate this challenging economic environment. Despite the slight projected recovery in demand, the overall outlook remains cautious as industry players strive to maintain profitability amid ongoing uncertainties.

Incorporating insights from industry experts enhances our understanding of the current state of trailer orders and freight markets. According to Dan Moyer, Senior Analyst at FTR:

“With builds continuing to outpace new orders, OEMs face mounting pressure to balance production against a thinning pipeline. Unless order activity strengthens with the opening of 2026 order boards, the industry may confront additional headwinds heading into next year.”

Moyer emphasizes the importance of monitoring the balance between trailer production and new orders to gauge future trends.

Jennifer McNealy, Director of Commercial Vehicle Market Research at ACT Research, remarked:

“Though past the traditional peak, we’re still in a period of ‘strong order’ intake. However, we expect continued weakness in trailer demand due to factors such as low used truck values reducing incentive for new trailer purchases, high dealer inventories limiting demand, and high interest rates discouraging new investments.”

Her commentary reflects the cautious outlook for the market amidst fluctuating demand.

Lastly, Ken Vieth, President and Senior Analyst at ACT Research, noted:

“Additionally, some trailer segments are impacted by specific economic markets. For example, softer oil prices are trailer-type specific and responsible for tank trailer weakness.”

Vieth’s insights highlight how external economic factors can significantly affect specific segments of trailer orders.

These expert quotes illustrate the nuanced challenges within the industry, underpinning the broader trends of economic uncertainties that carriers must navigate as they make decisions about fleet expansion and operational strategies.

Impact on Carrier Profitability

Reduced trailer orders suggest a cautious investment climate among carriers, which directly impacts their ability to expand and optimize their fleet. Key implications include:

- Reduced Fleet Growth: Many carriers are not only halting expansions but also shrinking their fleets. Some reports indicate a 2.2% reduction in fleet sizes aimed at better aligning costs with diminished demand. As demand for freight continues to wane, these reductions may lead to less capacity in the market.

- Increased Costs: Carriers face heightened operational costs due to ongoing economic conditions. Factors such as tariff increases on steel and aluminum have further inflated the costs of acquiring new trailers. This forces many to defer investments in fleet upgrades and maintenance, exacerbating financial pressures and leading to tighter profit margins.

User Adoption of Trucking Technology

The trucking industry is rapidly adopting advanced technologies such as autonomous trucks and routing software to enhance efficiency and reduce operational costs. Here’s a summary of the current state of user adoption and its potential impacts:

Autonomous Trucks

Autonomous trucks are increasingly becoming a key player in the transportation landscape, with projections indicating that more than 400,000 autonomous-ready trucks will be operational by 2025. This shift is expected to reduce operational costs by up to 45% by that time, primarily achieved through a significant decrease in labor expenses, which account for about 40% of total operational costs in freight companies. Companies like Aurora Innovation are already piloting commercial driverless operations in Texas, addressing pressing issues such as driver shortages and high turnover rates among drivers.

Routing Software and AI Integration

The integration of artificial intelligence (AI) and machine learning in routing software is significantly enhancing operational efficiency. AI-driven route optimization can improve fuel efficiency by up to 15% and shorten delivery times by the same amount. Furthermore, predictive maintenance fueled by AI can reduce vehicle downtime by 30%, leading to additional cost savings.

Impact on Freight Costs and Efficiency

The widespread adoption of these technologies is set to transform the trucking sector by lowering operational costs and boosting efficiency. Autonomous trucks will be able to operate continuously without driver breaks, potentially halving delivery lead times. Additionally, AI-powered systems can optimize load matching and route planning, which may result in a 20% decrease in empty miles driven alongside a 25% surge in delivery speed.

In conclusion, the trucking industry’s embrace of autonomous vehicles and AI-driven technologies promises enhanced operational efficiency and cost reductions, effectively addressing longstanding industry challenges including labor shortages and safety concerns.

In conclusion, the trucking industry is navigating through a period marked by significant economic challenges and uncertainties. The notable decline in trailer orders, recently recorded at just 7,261 units in August, is a clear indication of the cautious investment climate among carriers. This drop, which falls substantially below the 10-year average, represents not only immediate impacts on fleet expansion but also highlights broader economic dynamics affecting the industry.

As inflation and elevated interest rates persist, truckload margins are under substantial pressure, leading to a contraction in profitability for many carriers. These factors have resulted in reduced fleet growth as carriers grapple with the ongoing volatility in freight demand. Analysts maintain that while some signs of recovery in freight rates may emerge in the latter half of 2025, the overall outlook for the trucking sector remains cautious. Industry players must remain vigilant, continuously reassessing their strategies to navigate these complexities while striving to maintain operational viability and profitability in the face of challenging economic tides.

As Gucci Mane wisely stated, “I hope my life is a testimony to show people no matter what you go through, how many hurdles are placed in front of you… to pick yourself up and be resilient and keep on trucking.” Analysts maintain that while some signs of recovery in freight rates may emerge in the latter half of 2025, the overall outlook for the trucking sector remains cautious. Industry players must remain vigilant, continuously reassessing their strategies to navigate these complexities while striving to maintain operational viability and profitability in the face of challenging economic tides.

Call to Action for Industry Stakeholders

As economic uncertainty continues to reshape the trucking landscape, it is crucial for industry stakeholders to stay informed about evolving economic trends affecting freight margins and market dynamics. By understanding the impacts of declining trailer orders, inflation, and fluctuating interest rates, stakeholders can adapt their strategies accordingly to safeguard profitability and sustainability.

Participate in industry forums, subscribe to analytical reports, and engage with thought leaders in the sector to gain valuable insights that will help you navigate these turbulent times. Let’s work together to foster resilience and innovation in the trucking industry, ensuring we remain competitive and responsive to the changing economic environment.

Introduction

The trucking industry is currently grappling with an array of economic challenges that have significantly reshaped its landscape. As freight markets face increased volatility due to fluctuating demands, the margins for truckload carriers are being squeezed tighter than ever. A telltale sign of this turbulence is the recent decline in trailer orders, which dropped to a staggering 7,261 units in August—10,000 units below the 10-year average for that month. This drop not only highlights the immediate impacts of cautious fleet investment but underscores broader market dynamics that have left many carriers slowing down their growth plans. With these developments, industry leaders must navigate a cautiously optimistic path amidst emerging uncertainties, driving focus on a reassessment of strategies to maintain profitability and sustainability in the face of shifting economic tides.

Trailer Order Statistics

In August 2023, trailer orders in the U.S. trucking industry faced a significant downturn, totaling only 7,261 units, which is 10,000 units below the 10-year average of 17,568 units for that month. This decline can be attributed to various factors:

- Economic Uncertainty and Tariffs: Ongoing trade tensions and tariff volatility have resulted in increased operational costs and marketplace unpredictability, prompting trucking fleets to proceed with caution in placing new trailer orders.

- Weak Freight Demand: A sluggish freight market marked by lower volumes and rates has reduced the necessity for additional trailers among carriers.

- Elevated Cancellations: The industry has experienced a higher-than-normal rate of cancellations, remaining above 30% for four consecutive months leading into August.

Despite the August decline, there were some contrasting trends. Orders were down 4% from July but up 3% year-over-year. Moreover, the year-to-date net order total reached 109,800 units, reflecting a 23% improvement compared to the same period in 2024.

These statistics highlight persistent economic challenges affecting the trucking sector, indicating a rigorous environment for fleet expansion while maintaining careful strategy navigation to sustain profitability amid shifting market conditions.

Trailer Orders Comparison

| Month | Total Orders | MoM Change | YoY Change |

|---|---|---|---|

| March | 21,516 | +3% | +70% |

| April | 10,669 | -50% | -23% |

| May | 6,738 | -34% | +3% |

| August | 7,261 | -4% | +3% |

Notes:

- Data reflects fluctuations in trailer orders as the trucking industry faces ongoing economic challenges.

Sources:

Overview of Economic Trends Affecting the Trucking Industry

The U.S. trucking industry is currently navigating through challenging economic waters significantly influenced by inflation, interest rates, and fluctuations in freight rates. These trends are reshaping the operational landscape for truckload carriers, impacting their margins and overall demand.

Inflation Impact

As inflation continues to rise, operational costs within the trucking sector are also experiencing notable increases. For example, diesel fuel prices have surged over 30% since early 2022, representing a critical expense for trucking operations. The costs for new trucks and trailers have also escalated significantly, with equipment prices soaring by 20-40% over the past 18 months. Such increases result in tighter profit margins for carriers as they grapple with the dual burden of rising costs and declining revenues.

Furthermore, the competition for freight has intensified. With inflation eroding consumer purchasing power, the demand for goods has softened, leading to lower freight volumes. This situation deepens the competition among trucking firms, further driving down freight rates and squeezing margins. Analysts predict that while freight volumes may rise modestly by about 1% in 2025, the current economic uncertainty will continue to complicate recovery efforts.

Interest Rates

Higher interest rates, initiated to control inflation, have also played a role in shaping trucking dynamics. Elevated interest rates have curbed consumer spending and slowed industrial output, leading to reduced demand for freight services. Forecasts indicate that these rates, in conjunction with inflation, might lead to a more prolonged period of cautious freight demand.

Additionally, the burden of higher borrowing costs impacts trucking companies directly, as they may curtail investments in fleet expansion and maintenance due to increased financing expenses. This conservative approach towards capital investments feeds back into the freight market, where capacity constraints can lead to increased volatility in rates and service availability.

Freight Rate Fluctuations

Freight rates have exhibited variability influenced by tariffs, trade policies, and changing market conditions. A recent spike in cross-border trucking rates was triggered by new tariffs implemented on imports, as carriers rushed to mitigate costs, although many of these effects have since leveled out. Predictions suggest a potential adjustment upward in freight rates as demand strengthens in the latter half of 2025, but this recovery is contingent on broader economic stability and improvements in consumer confidence.

Summary

In summary, the interconnected impacts of inflation and interest rates are exerting downward pressure on truckload margins, while freight rate fluctuations add layers of complexity for trucking firms attempting to navigate this challenging economic environment. Despite the slight projected recovery in demand, the overall outlook remains cautious as industry players strive to maintain profitability amid ongoing uncertainties.

Declining Trailer Orders

Expert Insights on Trailer Orders and Freight Markets

Incorporating insights from industry experts enhances our understanding of the current state of trailer orders and freight markets. According to Dan Moyer, Senior Analyst at FTR:

“With builds continuing to outpace new orders, OEMs face mounting pressure to balance production against a thinning pipeline. Unless order activity strengthens with the opening of 2026 order boards, the industry may confront additional headwinds heading into next year.”

Moyer emphasizes the importance of monitoring the balance between trailer production and new orders to gauge future trends.

Jennifer McNealy, Director of Commercial Vehicle Market Research at ACT Research, remarked:

“Though past the traditional peak, we’re still in a period of ‘strong order’ intake. However, we expect continued weakness in trailer demand due to factors such as low used truck values reducing incentive for new trailer purchases, high dealer inventories limiting demand, and high interest rates discouraging new investments.”

Her commentary reflects the cautious outlook for the market amidst fluctuating demand.

Lastly, Ken Vieth, President and Senior Analyst at ACT Research, noted:

“Additionally, some trailer segments are impacted by specific economic markets. For example, softer oil prices are trailer-type specific and responsible for tank trailer weakness.”

Vieth’s insights highlight how external economic factors can significantly affect specific segments of trailer orders.

These expert quotes illustrate the nuanced challenges within the industry, underpinning the broader trends of economic uncertainties that carriers must navigate as they make decisions about fleet expansion and operational strategies.

Impact on Carrier Profitability

Reduced trailer orders suggest a cautious investment climate among carriers, which directly impacts their ability to expand and optimize their fleet. Key implications include:

- Reduced Fleet Growth: Many carriers are not only halting expansions but also shrinking their fleets. Some reports indicate a 2.2% reduction in fleet sizes aimed at better aligning costs with diminished demand. As demand for freight continues to wane, these reductions may lead to less capacity in the market.

- Increased Costs: Carriers face heightened operational costs due to ongoing economic conditions. Factors such as tariff increases on steel and aluminum have further inflated the costs of acquiring new trailers. This forces many to defer investments in fleet upgrades and maintenance, exacerbating financial pressures and leading to tighter profit margins.

User Adoption of Trucking Technology

The trucking industry is rapidly adopting advanced technologies such as autonomous trucks and routing software to enhance efficiency and reduce operational costs. Here’s a summary of the current state of user adoption and its potential impacts:

Autonomous Trucks

Autonomous trucks are increasingly becoming a key player in the transportation landscape, with projections indicating that more than 400,000 autonomous-ready trucks will be operational by 2025. This shift is expected to reduce operational costs by up to 45% by that time, primarily achieved through a significant decrease in labor expenses, which account for about 40% of total operational costs in freight companies. Companies like Aurora Innovation are already piloting commercial driverless operations in Texas, addressing pressing issues such as driver shortages and high turnover rates among drivers.

Routing Software and AI Integration

The integration of artificial intelligence (AI) and machine learning in routing software is significantly enhancing operational efficiency. AI-driven route optimization can improve fuel efficiency by up to 15% and shorten delivery times by the same amount. Furthermore, predictive maintenance fueled by AI can reduce vehicle downtime by 30%, leading to additional cost savings.

Impact on Freight Costs and Efficiency

The widespread adoption of these technologies is set to transform the trucking sector by lowering operational costs and boosting efficiency. Autonomous trucks will be able to operate continuously without driver breaks, potentially halving delivery lead times. Additionally, AI-powered systems can optimize load matching and route planning, which may result in a 20% decrease in empty miles driven alongside a 25% surge in delivery speed.

In conclusion, the trucking industry’s embrace of autonomous vehicles and AI-driven technologies promises enhanced operational efficiency and cost reductions, effectively addressing longstanding industry challenges including labor shortages and safety concerns.

Conclusion

In conclusion, the trucking industry is navigating through a period marked by significant economic challenges and uncertainties. The notable decline in trailer orders, recently recorded at just 7,261 units in August, is a clear indication of the cautious investment climate among carriers. This drop, which falls substantially below the 10-year average, represents not only immediate impacts on fleet expansion but also highlights broader economic dynamics affecting the industry.

As inflation and elevated interest rates persist, truckload margins are under substantial pressure, leading to a contraction in profitability for many carriers. These factors have resulted in reduced fleet growth as carriers grapple with the ongoing volatility in freight demand. Analysts maintain that while some signs of recovery in freight rates may emerge in the latter half of 2025, the overall outlook for the trucking sector remains cautious. Industry players must remain vigilant, continuously reassessing their strategies to navigate these complexities while striving to maintain operational viability and profitability in the face of challenging economic tides.

Call to Action for Industry Stakeholders

As economic uncertainty continues to reshape the trucking landscape, it is crucial for industry stakeholders to stay informed about evolving economic trends affecting freight margins and market dynamics. By understanding the impacts of declining trailer orders, inflation, and fluctuating interest rates, stakeholders can adapt their strategies accordingly to safeguard profitability and sustainability. Participate in industry forums, subscribe to analytical reports, and engage with thought leaders in the sector to gain valuable insights that will help you navigate these turbulent times. Let’s work together to foster resilience and innovation in the trucking industry, ensuring we remain competitive and responsive to the changing economic environment.

The trucking industry is navigating through significant economic challenges shaped by inflation, interest rates, and fluctuating freight rates dynamics. The recent decline in trailer orders represents a cautious investment climate among carriers, indicating a need to adapt strategies for profitability amidst uncertainties.

Integration of SEO Keywords

To optimize visibility and relevance of this article, we have integrated essential related keywords throughout the content:

- Freight Rates Dynamics: With freight rates fluctuating due to economic pressures, carriers face increased operational costs and reduced margins. In September 2025, for instance, Very Large Crude Carriers saw a substantial rise in rates due to limited availability, illustrating the sensitivity of the trucking industry to global oil changes.

- Trucking Technology Trends: Advancements in autonomous vehicles and predictive maintenance are transforming operational efficiency. Notably, Waabi’s partnership with Volvo aims to roll out self-driving trucks by 2025 amid rising driver shortages. These innovations are set to reduce labor costs and enhance fleet management.

- Economic Impact on Trucking: The ongoing trade war and rising tariffs are underlining the economic impact on trucking, reshaping operational costs and demand patterns. Furthermore, the EPA’s new emissions standards for heavy-duty trucks could significantly alter the cost structure of carriers, impacting profitability.

These keywords not only enhance SEO but also reflect current industry trends, inviting stakeholders to adapt to evolving dynamics in the trucking sector.