The trailer market finds itself at a pivotal crossroads as it grapples with the ramifications of persistently weak freight demand. In August 2025, net trailer orders dwindled to a worrying 7,261 units—a stark 4% decline from the previous month and significantly below the ten-year average of 17,568 units.

This downward trend is echoed in the production statistics, as trailer output fell by 5% month-over-month and 6% year-over-year, with backlogs now at their weakest level since June 2020. The U.S. freight sector is not faring any better, with projections suggesting a further decline in import volumes, dipping below two million TEUs for the first time since March 2023.

With fleet operators postponing equipment acquisitions in light of these market conditions, confidence in the industry remains fragile. As new tariffs impose additional pressures on pricing and supply chains, the landscape for trailer manufacturers becomes increasingly uncertain.

With these challenges persisting, the outlook for recovery appears complex and tentative at best.

Industry Decline

The trailer industry is currently grappling with significant declines in order activity that spotlight broader market challenges. In July 2025, net trailer orders plummeted by 39% compared to June, with total orders falling to only 8,800 units. This sharp decrease starkly illustrates the industry’s struggle to maintain robust demand amid uncertain economic conditions.

In addition to this startling monthly decline, overall trailer order activity has seen a 5% decrease. These drops are part of a concerning trend that raises questions about the future of trailer production and sales within the broader freight market context.

Key Declining Statistics:

- July Orders: Down 39% from June.

- Overall Activity: 5% decline in order activity.

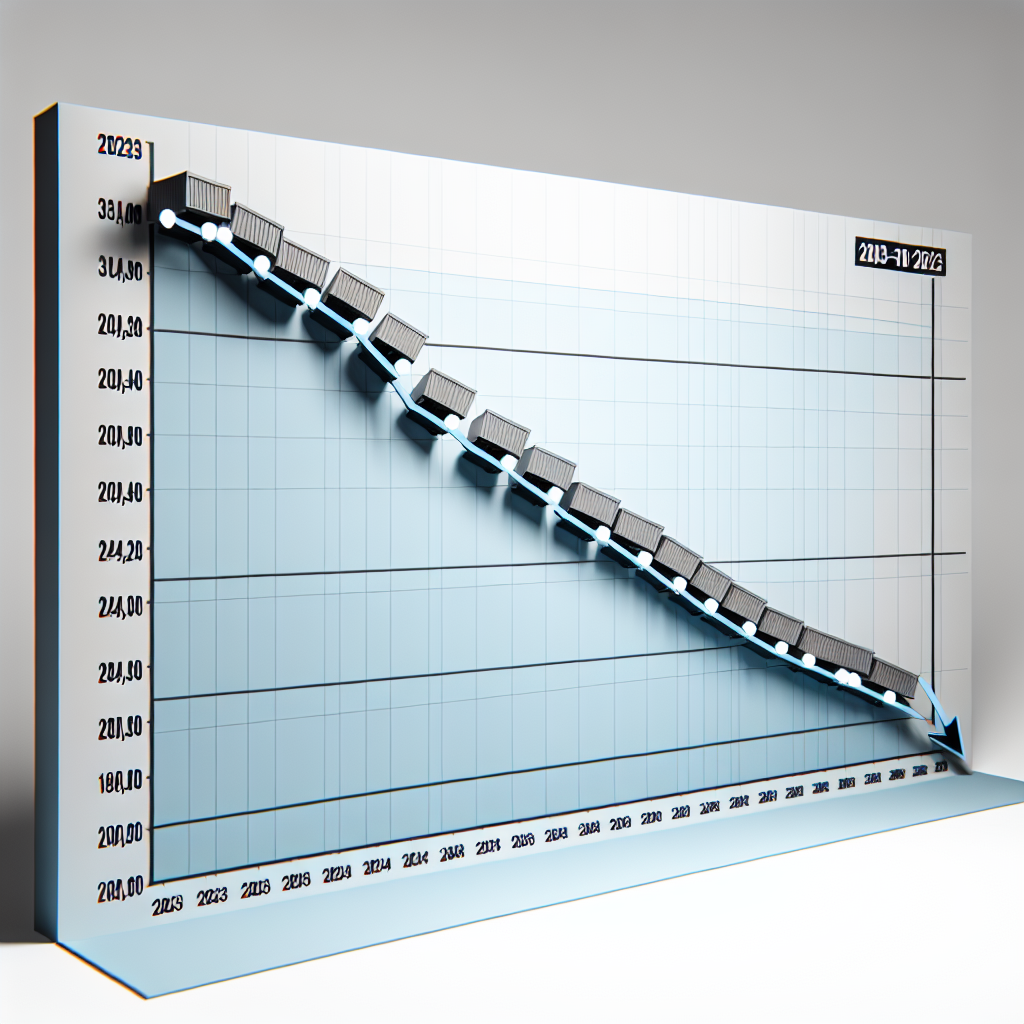

- Production Forecast: Projected trailer production for 2025 stands at 187,000 units, down from 230,000 in 2024 and significantly lower than 314,000 in 2023.

- Market Context: Industry experts suggest that the slowdown in trailer orders is reflective of fleet operators’ reluctance to make large capital expenditures, given the current weak freight climate.

These statistics underscore a cautious outlook for the industry, as there are few signs of a near-term recovery. The interconnected issues of supply chain constraints, rising costs, and shifting demand patterns continue to pose serious challenges to the trailer market. As fleets delay purchases and reconsider their equipment needs, manufacturers must navigate these complex dynamics to adapt effectively to an evolving industry landscape.

The current situation reflects a critical moment for trailer makers as they adjust their strategies in response to market realities. With fleet operators seeking to optimize operational efficiency rather than expand, the pressure on manufacturers continues to mount, making it imperative to understand and address the roots of this decline.

Industry Sentiment

The sentiment surrounding the trailer market is increasingly cautious. Industry leaders like Charles Dutil and John Foss have expressed their concerns about the continuing uncertainty impacting fleet operators, resulting in postponed trailer purchases and a hesitance to make large orders.

Charles Dutil shared a critical insight, stating, “Certainly, I think there’s no confidence [among customers] to go out and place great big orders for new equipment.” This resonates strongly with the current market conditions, where uncertainties loom large over purchasing decisions.

Adding to this sentiment, Dutil noted, “A fleet with 50 trucks will usually replace 10, 12, or 15 trailers per year,” underscoring the typical replacement cycles that fleets are now stretching in light of the current landscape.

As the industry confronts supply chain challenges and escalating costs driven by tariffs on materials like steel and aluminum, the implications for trailer pricing become evident. With experts predicting price adjustments tied to these tariffs, it becomes increasingly crucial for fleet operators to navigate these complexities carefully.

In summary, the challenging atmosphere for the trailer market is compounded by cautious sentiment among industry leaders. The voices of Dutil and Foss encapsulate the broader concerns that are influencing the trajectory of trailer purchases during this tumultuous period.

Manufacturer Responses to Weak Demand

In light of the weakened demand for trailers, manufacturers like Manac and Fontaine Trailer Company are taking proactive steps to adapt their production strategies. As of 2025, both companies have made significant adjustments to their operations to navigate this challenging environment.

Manac

Manac has reported a substantial decrease in production, with output falling by 28% in 2024 compared to 2023. The primary drivers for this decline include reduced demand in key segments such as vans and flatbeds, alongside a reduction in backlogs. Despite these challenges, CEO Charles Dutil remains cautiously optimistic as they anticipate stronger demand in the latter half of 2025. However, uncertainties, particularly related to U.S. tariffs, continue to loom. Notably, in July 2024, Manac secured $170 million in financing to expand its premier manufacturing facility in Saint-Georges, Quebec. This expansion includes the development of new sales and service centers throughout Canada. Such strategic investment is aimed at integrating innovative technologies to comply with changing regulatory requirements and to better position the company against competitive pressures.

Fontaine Trailer Company

Fontaine is also adapting its strategies in light of current market conditions. The company has been diversifying its supply chain to reduce risks associated with tariffs and supply chain disruptions. President Alan Briley emphasizes the necessity for open communication with suppliers, which is crucial for preparing for future demand fluctuations. This streamlined approach not only enhances their operational efficiency but also fortifies their readiness against unexpected market shifts.

Overall, both manufacturers are taking significant steps to respond to the current market realities. They are focusing on production adjustments, strategic expansions, and enhanced communication within their supply chains to better manage the impacts of weakened demand and position themselves for recovery in the future.

These adaptive measures are essential as the trailer market braces for complex dynamics in the coming years.

Summary

In summary, companies like Manac and Fontaine Trailer Company are navigating the choppy waters of reduced trailer demand through strategic pivots and investments aimed at long-term resilience and performance.

| Manufacturer | Production Rates | Market Response Strategies | Forecasts |

|---|---|---|---|

| Manac | Produced approximately 7,000 trailers in 2020, 15% decrease from previous year. | Halting trailer replacements, extending life of existing equipment. | Anticipates market rebound by mid-2026, with potential price increases. |

| Fontaine Trailer Company | Specific recent production figures not disclosed. | Diversifying supply chain to mitigate tariffs and communication with suppliers. | No specific forecasts detailed, focusing on supply chain adjustments. |

| Trailcon Leasing | Manages a fleet of approximately 12,000 trailers, does not manufacture. | Enhancing maintenance services and recycling decommissioned trailers. | Concerns about prolonged downturn; current conditions unprecedented. |

| Penguin Trailers | Specific production figures are not publicly available. | Emphasizing inspection programs and regular maintenance for safety. | No specific forecasts given, focusing on maintenance for current challenges. |

Potential Price Increases Due to Tariffs

The implementation of tariffs on steel and aluminum has led to significant price increases for van trailers, with costs rising between 16% and 28%. This escalation is primarily due to the heavy reliance of trailer manufacturing on these metals. According to a report, Dan Moyer, a senior analyst at FTR, estimates that tariffs have added 16-18% to the cost of dry van and reefer trailers. Jason Miller from Michigan State University further emphasizes that steel and aluminum constitute up to 35% of a trailer’s value, amplifying the impact of tariffs on overall costs.

Implications for Fleet Purchasing Decisions:

- Delayed Purchases: Due to inflated prices and market uncertainty, fleets are postponing new trailer acquisitions. A survey indicated that 80% of fleets are not planning to purchase new trailers this year, choosing instead to buy only for specific requirements.

- Extended Equipment Lifecycles: To mitigate costs, fleets are opting to extend the service life of their existing trailers. This approach may lead to an aging fleet and potential maintenance challenges over time.

- Increased Cancellations: The trailer industry has witnessed a surge in order cancellations, with claims that rates reached 37.6% of gross orders in May 2025, the highest in a year.

In summary, the tariffs have substantially increased van trailer prices, prompting fleets to reassess their purchasing strategies. This reconsideration is leading to delayed acquisitions and extended use of current equipment as companies navigate the financial pressures imposed by these trade policies.

Conclusion

In conclusion, the trailer market finds itself navigating a challenging landscape characterized by declining demand and a cautious sentiment among industry players. With trailer orders plummeting and production rates reflecting a significant downturn, manufacturers are responding with strategic adjustments aimed at weathering the storm. Additionally, the outlook for the trailer market and associated trends remains complex as companies like Manac and Fontaine Trailer Company reevaluate their operations in the context of the trailer market outlook. They remain poised for recovery even as uncertainties about freight demand continue to loom.

While there is guarded optimism regarding a potential rebound, particularly in the latter half of 2025, the overall outlook remains tentative. The combination of elevated prices due to tariffs and prolonged fleet hesitance indicates that a swift recovery may not be on the horizon. The industry must remain vigilant and adaptable to the evolving market dynamics, as confidence among fleet operators fluctuates. For now, the cautious approach adopted by manufacturers and stakeholders reflects a broader understanding that the path to recovery is fraught with challenges and uncertainties yet to be addressed.

Recent Fleet Trailer Adoption Data Summary

In 2025, the U.S. trailer market experienced notable fluctuations influenced by economic uncertainties, tariff implementations, and shifting fleet purchasing behaviors.

- Market Trends: In January, net trailer orders surged to 23,966 units, marking an impressive 81% year-over-year increase. However, this initial robust performance did not last long. By April, orders dramatically fell 50% month-over-month to just 10,669 units. The steepest decline occurred in May, where net orders dropped further to 6,738 units, coinciding with a significant rise in cancellations, reaching 37.6% of gross orders—the highest in 12 months.

- Impact of Economic Conditions: Escalating tariffs on essential materials, mainly steel and aluminum, have significantly raised production costs, causing prices for van trailers to soar between 16-28%. As these costs increase, fleet operators face mounting pressure to extend the service lives of their existing trailers rather than invest in new purchases.

- Cautious Sentiment Among Fleets: A recent survey indicates that about 80% of fleets are opting not to purchase new trailers this year, focusing instead on replacing only essential units. This trend illustrates a shift toward prioritizing existing assets amidst ongoing market uncertainties.

- Conclusion: The current state of the trailer market reflects a complex web of economic pressures, with rising production costs due to tariffs and significant hesitance in purchasing behavior among fleet operators. Collectively, these factors pose substantial challenges to growth in trailer adoption as fleets navigate through a tumultuous market environment.

Manufacturer Responses to Weak Demand

Due to the low demand for trailers, manufacturers like Manac and Fontaine Trailer Company are adjusting their production strategies. In 2025, both companies have made significant changes to deal with this challenging situation.

Manac

Manac has seen a big drop in production, with output falling by 28% in 2024 compared to 2023. This decline is mostly due to reduced demand in key areas like vans and flatbeds and fewer back orders. Even with these challenges, CEO Charles Dutil is cautiously optimistic, expecting stronger demand in the latter half of 2025. However, uncertainties about U.S. tariffs remain. In July 2024, Manac secured $170 million in financing to expand its main manufacturing facility in Saint-Georges, Quebec. This includes developing new sales and service centers across Canada using innovative technologies to meet changing regulations and better compete.

Fontaine Trailer Company

Fontaine is also changing its strategies due to the current market situation. The company is diversifying its supply chain to lower risks from tariffs and disruptions. President Alan Briley emphasizes the importance of communicating openly with suppliers to prepare for future demand changes. This streamlined approach boosts their operational efficiency and strengthens their readiness for market shifts.

Both manufacturers are taking significant steps to cope with the current market realities. They focus on adjusting production, strategic expansions, and improving communication within their supply chains to manage the effects of weak demand and prepare for recovery.

These adaptive measures are critical as the trailer market deals with complex dynamics in the coming years.

Summary

In summary, companies like Manac and Fontaine Trailer Company are navigating the reduced trailer demand through strategic changes and investments for long-term resilience and performance.

| Year | Price Increase (%) | Cargo Type | Source |

|---|---|---|---|

| 2024 | 16% | Dry Van | FTR |

| 2024 | 18% | Reefer | FTR |

| 2025 | 28% | Standard | Industry Report |

| 2025 | 25% | Flatbeds | Economists |

| 2025 | 20% | Specialized | Manufacturer Insights |

| 2026 (forecast) | 22% | General Cargo | Analysts |

This table summarizes recent price increases in various trailer categories, illustrating the market impact of tariffs on manufacturing costs. It highlights the significant variations in price changes for different cargo types over the years, allowing potential buyers to understand the evolving pricing landscape.

These adaptive measures are critical as the trailer market deals with complex dynamics in the coming years. Furthermore, the implications of their operational changes may lead to substantial shifts in pricing structures due to external pressures like tariffs. Consequently, it’s essential to explore how these manufacturer responses are intertwined with potential price increases across the market.