The landscape of trailer purchases is currently reflective of broader economic challenges, severely impacted by a sluggish freight market. As fleets confront weak demand, trailer makers are experiencing significant setbacks, with production orders plummeting and forecasted price increases looming due to tariffs.

This environment necessitates a recalibrated approach; manufacturers must rethink strategies in anticipation of cautious spending by fleet operators wary of plunging into new acquisitions. With prices surging by upwards of 28% and order activity diagnosed with a striking 5% decline, the time for reflection and recalibration is now.

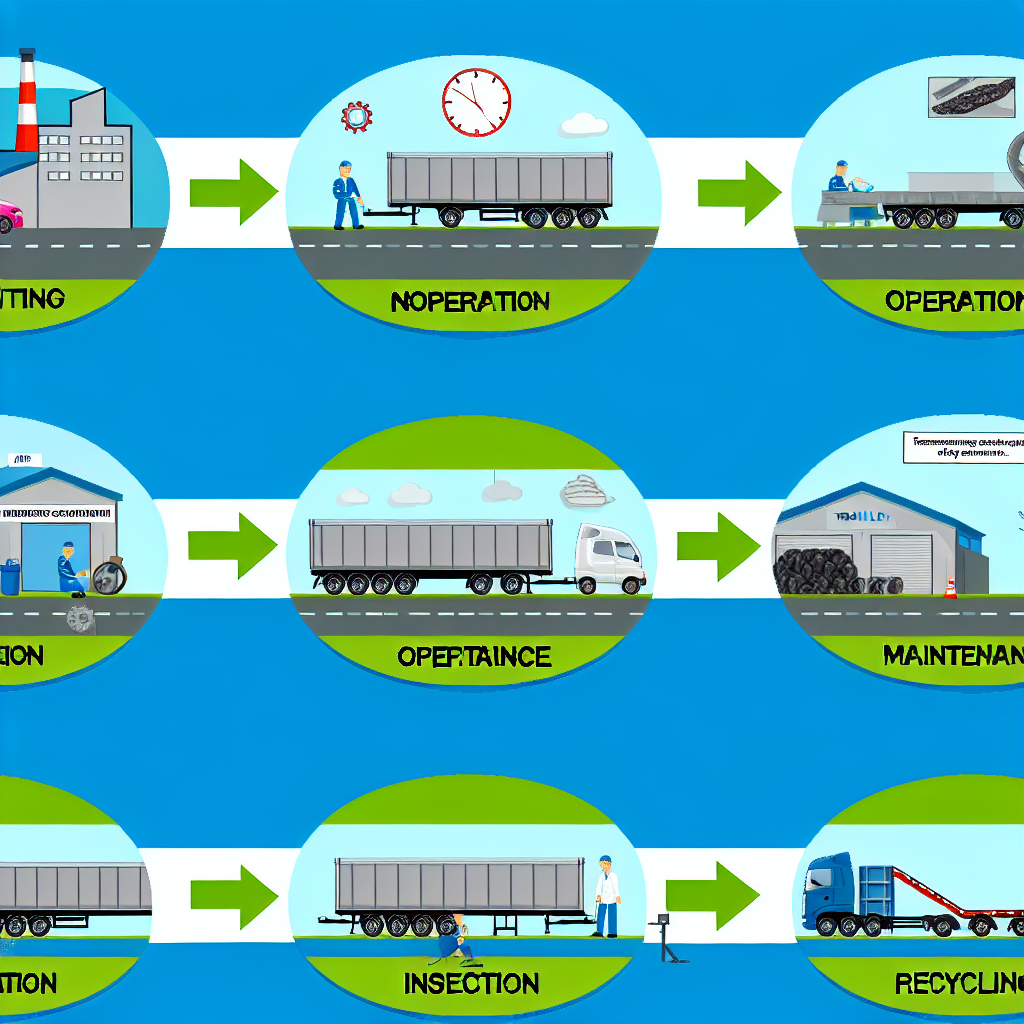

Industry leaders urge a careful assessment of existing trailer inventories and a robust trailer maintenance strategy to extend the lifecycle of current fleets. As we delve deeper into the state of the industry, this article will explore how trailer makers are adapting to these realities and what the future holds for trailer purchases amidst ongoing market volatility.

Trailer Production Statistics

Recent statistics reveal a challenging landscape for trailer production amidst economic uncertainties and the looming effects of tariffs. In May 2025, there was a notable decline in net trailer orders, dropping to 6,738 units, a 34% decrease from the previous month. This trend continued, with July witnessing a significant 39% drop in orders to 7,794 units, although year-over-year comparisons indicated a 23% increase compared to July 2024, signaling some resilience in the market despite current challenges.

As manufacturers grapple with fluctuating orders, the anticipated price hikes are becoming an additional concern. Analysts predict an increase in trailer prices by 16% to 28% due to tariffs that are contributing to rising operational costs across the industry. These prices are reflective of broader costs that manufacturers are facing, stemming from imported materials and components becoming more expensive due to increased tariffs. Fleet managers are urged to reconsider ordering timelines; as Charles Dutil, a prominent industry figure, notes, waiting too long to reorder could exacerbate costs.

The precarious balance between supply, demand, and pricing makes it imperative for trailer makers to adapt strategically. Operational adjustments to manage costs effectively while meeting the needs of fleet operators will be key to navigating these turbulent times. The expectation is that prices will continue to rise as tariffs impact suppliers, prompting a closer look at existing inventories and maintenance practices to prolong the life cycle of current trailers, ultimately benefiting fleet management in this volatile market.

User Adoption Data of Trailer Inspection Programs and Service Life Recommendations

In recent years, regular trailer inspections and maintenance have become crucial for ensuring safety and compliance, as well as maximizing the lifespan of trailer assets in the trucking industry. Although it can be hard to determine exact user adoption numbers for trailer inspection programs, several studies emphasize the need for proactive maintenance. This strategy is essential for improving both safety and the longevity of trailer investments.

Expert Insights on Market Trends and Fleet Management Strategies

In the ever-evolving trailer and trucking industry, insights from seasoned professionals can illuminate paths for fleet managers navigating the challenging landscape. Here are key quotes from industry experts Dan Moyer, John Foss, and Charles Dutil, reflecting on current market trends and strategies for effective fleet management.

Dan Moyer, Senior Analyst at FTR:

“Fleet orders for trailers have seen a concerning decline, with a 5% decrease noted recently and an alarming 39% drop in July orders compared to the previous month. This is a clear indication of weak freight demand and high cancellation rates. Furthermore, we expect van trailer prices to increase by 16% to 28% due to ongoing tariffs on essential materials. It is crucial for manufacturers to adjust production rates wisely to prevent market oversaturation.” [Source]

John Foss, Trailer Expert:

“The importance of maintaining existing equipment cannot be overstated. Clean and well-maintained trailers not only prevent delays but also enhance resale value. A rigorous maintenance program can significantly extend the lifecycle of a trailer, which is crucial in today’s market climate. Fleet managers should focus on developing solid maintenance strategies rather than being caught up only in new acquisitions.”

Charles Dutil, CEO of Manac:

“In challenging freight markets, we often observe a stark reduction in replacement purchases. A fleet that typically replaces a dozen trailers might end up deferring all replacements altogether. This postponement can drastically impact the operational efficiency of fleet operations, as well-maintained trailers are key to sustaining logistics performance. As conditions improve, the focus will need to shift back towards renewing equipment to ensure competitiveness.” [Source]

These insights highlight the critical intersection of market conditions and strategic planning. Fleet managers are advised to remain proactive in maintaining their current assets while carefully strategizing future acquisitions, ensuring that business operations can withstand economic fluctuations efficiently.

| Trailer Maker | Production Rate Impact | Price Changes | Market Strategies |

|---|---|---|---|

| Trailcon | Decreased production by 20% | Prices expected to rise 16-28% | Emphasizing maintenance programs and inspections |

| Manac | Overall production drop of 25% | Anticipating price increase due to tariffs | Focusing on customer relations and flexible financing options |

| Fontaine Trailer Company | Modest production reduction of 15% | Projected price increase of 20% | Adapting designs for longer lifespan |

| Penguin Trailers | 30% drop in production rates | Prices likely to increase by 18% | Exploring new markets for product diversification |

Adaptation Strategies of Trailer Companies

In light of the current weak freight market, companies like Trailcon and Manac are employing various strategies to remain competitive and adapt to shifting dynamics in the industry.

Emphasis on Maintenance and Lifecycle Extension

Trailcon, known for operating a fleet of approximately 12,000 trailers, has prioritized the implementation of rigorous inspection and maintenance programs. By inspecting between 1,500 to 2,000 trailers annually, the company underscores the importance of prolonging the usable life of existing assets. They recommend a maximum service life of 18 to 20 years for trailers, emphasizing that regular maintenance not only enhances safety but also helps avoid the significant costs associated with major repairs and replacements.

Innovation in Design and Product Development

Manac is actively innovating its production processes and product offerings. By adopting eco-friendly materials and incorporating sustainable practices, the company is responding to both market demand and regulatory pressure. This includes lightweight designs that improve fuel efficiency, which is vital in an industry increasingly focused on reducing carbon footprints.

Integration of Technology and Smart Features

Both companies are exploring advanced technology integration within their products. The introduction of telematics and smart trailers is becoming increasingly common, allowing for more efficient tracking of assets and optimized maintenance schedules.

Customization and Modular Design

Recognizing the varying needs of customers, trailer manufacturers are also shifting towards more customizable and modular designs. This adaptability enables operators to modify assets quickly to meet changing demands in freight transport, which is crucial in an environment marked by uncertainty and fluctuating freight volumes.

These strategic adaptations illustrate how trailer manufacturers are gearing up to face current challenges, ensuring they remain competitive and responsive to market shifts. As the freight market evolves, these companies are committed to aligning their operations with both economic realities and customer expectations.

Technological Innovations and Telematics

Incorporating technological innovations such as telematics has become essential for trailer companies aiming to optimize their operations in a challenging freight landscape. Telematics systems are increasingly utilized to provide real-time data on trailer location, condition, and usage patterns, enabling proactive maintenance strategies. By leveraging predictive analytics, companies can schedule maintenance more effectively, minimizing costly downtime and extending the lifecycle of their trailers. This shift towards data-driven decision-making enhances asset utilization and operational efficiency, helping companies navigate the complexities of a weak market. As trailer manufacturers like Trailcon and Manac integrate more of these smart technologies, they strengthen their competitive edge while simultaneously ensuring compliance and safety standards are met efficiently.

In summary, the current landscape of trailer purchases is characterized by significant challenges driven by a depressed freight market, which is causing fleet managers to hesitate in making new acquisitions. With production orders plummeting and prices expected to rise by as much as 28% due to tariffs, the urgency for strategic planning has never been more critical. The pressure from declining demand has left many trailer makers reassessing their production strategies while maintaining a fierce focus on cost control.

Fleet managers are therefore encouraged to adopt a proactive approach—not only should they consider future purchases, but they must also emphasize rigorous maintenance practices. Prioritizing maintenance helps to extend the lifecycle of existing trailers, mitigate rising costs, enhance safety and compliance, and prevent costly downtime and accidents.

Looking ahead, successful management in the trailer sector hinges on both strategic purchasing and maintaining a responsive mindset to evolving market demands. Fleet managers who embrace these strategies will be better positioned to navigate these turbulent times and prepare for recovery in the years ahead.

The article presents a coherent and well-structured narrative around the challenges faced by trailer makers in the current weak freight market. The introduction effectively establishes the context, clearly outlining the issues at hand, such as plummeting production orders and rising prices due to tariffs.

Each subsequent section follows logically, providing insights into statistical trends, the importance of regular maintenance, expert opinions, and adaptation strategies that trailer companies are employing. This consistent focus on navigation through market volatility ties the content together seamlessly.

The inclusion of expert quotes adds credibility and real-world perspectives, reinforcing the article’s arguments regarding proactive maintenance and strategic purchasing decisions.

However, to enhance coherence, it would be beneficial to emphasize the significance of maintenance earlier in the article, illustrating how it contributes to long-term cost savings for fleet managers amid increasing costs and decreasing demand. Furthermore, integrating discussions about innovation and technology within the adaptation strategies could provide deeper insights into how companies are evolving in response to current challenges.

Overall, while the article maintains a cautious yet informative tone, small adjustments could strengthen its narrative and ensure every section comprehensively supports the main message of navigating a turbulent market.

For comprehensive guidance on maintaining your trailers, consider exploring these best practices from reputable sources:

- 12 Essential Trailer Maintenance Tips by Andy’s Automotive & Truck Services, which provides a list of crucial maintenance tasks to keep your trailer in top shape.

- Ultimate Guide to Trailer Maintenance and Longevity by Wright-Way Trailers, covering essential monthly and seasonal maintenance routines.