The transportation industry faces unique challenges, particularly when navigating through harsh winter conditions. For logistics and freight companies, construction and mining enterprises, and small businesses with delivery fleets, equipping vehicles with the right tire chains is paramount. The best and newest commercial semi-truck tire chains not only enhance vehicle safety but significantly improve operational efficiency during adverse weather. This comprehensive overview aims to enlighten fleet owners and procurement teams about cutting-edge options, key features, market trends, best practices for utilization, and future innovations that promise to redefine the industry standards for tire chains.

null

null

Winter’s Grip: Decoding the New Wave of Commercial Semi-Truck Tire Chains for Durability, Fit, and Fleet Confidence

Winter drapes the highway in a weighing hush, and for fleets that move goods across icy corridors, tire chains are not a luxury but a line of defense. Yet the landscape around the newest commercial chains remains less a catalog of exact models and more a field of design priorities. What matters most in these heavy, high-stakes applications is not name recognition but a set of durable, verifiable traits that translate into safer traction, easier installation, and longer service life under relentless winter punishment. The most telling signals from the market point to chains built for heavy loads, with thickened, reinforced links and robust side segments that resist wear. They are engineered to stay intact when the weight of a loaded semi can bend ordinary hardware into failure. For fleets, this translates into fewer chain failures, less downtime, and a predictable maintenance cycle during the cold season. In a space where milliseconds count between gaining traction and skidding into a roadside emergency, those small design decisions accumulate into measurable safety and reliability gains.

A central thread across the latest options is durability. Chains intended for commercial semi-trucks must weather not only deep snow and ice but also the abrasive grit of salt, sand, and road debris that roughen surfaces and accelerate wear. You will hear designers talk about heavy-duty construction, thickened links, and reinforced crossmembers—terms that describe a chain built to resist deformation, fatigue, and fracture after repeated installations and removals. The emphasis on strength does not come at the cost of weight efficiency; rather, it reflects a careful balance where the chain remains manageable for fleet operators while resisting the harsher demands of long hauls and extreme weather. The era of flimsy, go-anywhere-but-break-fast chains is giving way to systems where metallurgy, heat treatment, and joint design cooperate to deliver predictable performance across a broad spectrum of temperatures and road conditions.

Beyond raw strength, fit and versatility emerge as equally vital pillars. Fleets today increasingly operate mixed tire fleets, and universal or broad-size-range chains offer a practical solution. A chain that can accommodate a wide swath of tire widths reduces the complexity of inventory, simplifies driver training, and lowers the risk of a misfit that could compromise traction or damage rims. The market’s momentum toward universality mirrors the realities of dispatch planning and maintenance cycles in large operations. In practice, universal-fit concepts translate into carefully engineered link spacing, adaptable tensioning mechanisms, and connector systems that can lock onto various tire profiles without sacrificing grip or durability. Those design choices help ensure that a single chain kit can cover multiple vehicle types within a fleet, from long-haul sleepers to regional tractors, without forcing a wholesale retrofit of winter equipment every season.

Another feature that retailers and fleets alike prize is containment and debris management. Enclosed or semi-enclosed chain designs, where possible, reduce the risk of ice, snow, and salt lodging between the chain and the tire or inside the wheel well. The result is less packing, which translates into smoother operation and reduced maintenance headaches. For commercial use, this matters not only for performance but also for compliance and safety inspections. A chain that minimizes foreign material intrusion is less prone to bind, loosen, or vibrate under load, which in turn reduces the likelihood of tire or wheel damage during braking, cornering, or traversing rough winter surfaces. Closer attention to this detail reveals a broader trend: an emphasis on engineering that supports long service cycles with predictable behavior, even when drivers are juggling duty schedules, varying routes, and time constraints.

The practical realities of winter operation underscore the importance of thoughtful installation and ongoing maintenance. For fleets, the best chains are those that cab drivers can mount correctly in less-than-ideal conditions, with clear guidance and forgiving terrain around the mounting points. That means more intuitive tensioning solutions, corrosion resistance for the mounting hardware, and thoughtful packaging that protects the links during transport and storage. It also means robust wear indicators so maintenance crews know when a link or a cross member has reached the end of its service life. In environments where cold starts, ice, and road salt can accelerate deterioration, empirical durability matters as much as initial grip. The most valuable chains are those that remain reliable across multiple seasons, resisting wear that would require premature retirement. While these attributes are not always advertised with product names, they are the underpinnings of long-term fleet performance and cost efficiency.

Design and procurement decisions must sit within a larger safety framework. Training drivers, documenting installation procedures, and maintaining a formal inspection routine are all essential to translating any chain’s theoretical performance into real-world safety outcomes. A chain that looks sturdy on a catalog page can still fail if drivers do not check tension, wear, and alignment before every use. The best practice is a simple routine: inspect each link for cracks or severe deformation, verify that tension is evenly applied, ensure no foreign material is lodged in the chain, and confirm the chain is compatible with the tire size and wheel without forcing contact with the wheel well or rim flange. In heavy-duty trucking, neglecting this routine is not just a inefficiency — it is a hazard that can turn snow-covered highways into collision courses. Fleet managers increasingly recognize that the value of a chain is measured not only by how quickly it can be deployed on a roadside but by how well it preserves tire integrity and vehicle control during critical decelerations and cornering in icy conditions.

From a strategic standpoint, the purchasing decision for commercial semi-truck tire chains rests on balancing durability, universal fit, and lifecycle cost. Fleets must weigh initial purchase price against expected service life, frequency of use, and the cost of downtime during winter storms. A chain built with reinforcement where wear is most intense—where the links bend, where the cross members take the brunt of wheel torque, and where tensioning components repeatedly engage—will typically offer the best return on investment. The market signals that matter most in this calculus include positive field feedback on wear resistance, a proven track record of staying intact under high loads, and compatibility with a fleet’s mixed tire configurations. Because the knowledge base does not document product-by-product specifications in detail, the prudent course for practitioners is to seek chains that demonstrate robust material science, transparent warranty provisions, and clear guidelines for use across a spectrum of tire sizes and vehicle weights.

In practice, this means approaching chain selection as a risk-management exercise rather than a purely price-driven choice. It also means recognizing that the newest options aren’t merely about incremental improvements but about how design choices tractably reduce the operational friction winter imposes on a fleet. The most consequential gains come from the alignment of three factors: a chain’s mechanical resilience, its ability to fit and adapt across a fleet, and the driver- and maintenance-team processes that keep it functioning when the weather tightens its grip on the highway. Even in the absence of one definitive specification catalog, these guiding principles help fleets identify the most suitable, reliable chains for commercial applications where the consequences of failure are measured in time, safety, and uptime.

For readers seeking a broader sense of winter-safety best practices that extend beyond the equipment itself, practical guidelines from national safety authorities emphasize planned preparedness, routine vehicle checks, and clearly communicated procedures for chain use. These resources, while not product catalogs, provide a reliable frame for evaluating the real-world performance of any chain design and for aligning procurement with an overall winter operations strategy.

External resource: https://www.nhtsa.gov/winter-driving

Traction Trends in the Commercial Truck Tire Chain Market: From Durability to Digital Tools

The market for commercial semi-truck tire chains is undergoing a careful, technology-driven evolution. It is moving beyond the long-standing reliance on rugged metal links and toward an ecosystem of traction solutions that marry strength with intelligence, speed, and sustainability. Fleet operators are not just seeking better grip in extreme conditions; they are pursuing systems that minimize downtime, optimize maintenance, and align with the broader push toward data-driven management. In this landscape, the most visible shifts are not just about sturdier chains, but about how those chains integrate with the vehicle, the fleet’s operations, and the regulatory environment that governs winter readiness and road safety.

One of the clearest threads in recent market development is the rise of advanced traction solutions that go beyond traditional metal chains. Electrically heated chain concepts, still in nascent stages in many markets, promise to reduce ice buildup on contact surfaces and maintain predictable traction even in sub-zero temperatures. While not ubiquitous, these heated innovations illustrate a direction in which reliability under freezing conditions is achieved through embedded technology rather than sheer metal weight alone. Alongside heating, smart chain systems are beginning to collect and transmit data about chain tension, wear, and road conditions in real time. This is a meaningful shift because it reframes tire chains from a simple wearable device into an active component of the vehicle’s safety and performance suite. The practical benefit is not only improved traction; it is the potential for fleets to monitor chain health and plan replacements before failures occur, cutting downtime during peak winter periods.

Another important trend is the move toward modular and quick-release designs. Fleets that operate across multiple regions or service mixes confront a wide variety of tire sizes and mounting conditions. The newest generation of chains is increasingly designed to adapt quickly, with fewer specialized tools required for installation and removal. This matters not just for the driver who must react to changing weather; it matters for fleet operations managers who must reduce cycle times for vehicle readiness, especially when weather events disrupt schedules. The cumulative effect is a reduction in the operational bottlenecks that heavy-duty chains historically created. In tandem with modularity, there is a growing emphasis on universal fit concepts. These are not a universal solution in the sense of perfect one-size-fits-all, but rather adaptable options that cover broad tire size ranges. For fleets with mixed alphanumeric ecosystems—different makes, models, and tire sets—universal or broadly compatible designs bring a welcomed level of simplicity to procurement and inventory.

These engineering advances sit within a broader trajectory toward smarter integration with vehicle telematics and fleet-management platforms. Modern fleets increasingly rely on centralized data ecosystems. Tire chain systems, whether traditional or advanced, can feed into these platforms to deliver a continuous picture of vehicle readiness and performance. Real-time monitoring can trigger automated alerts when the chain system shows abnormal wear, tension slack, or signs of damage. Predictive maintenance becomes possible when sensor data is fused with weather forecasts and route histories. The implication is straightforward: the value of the chain is enhanced when it becomes part of an intelligent, proactive maintenance cycle rather than a reactive requirement addressed only after a failure.

This digital tether extends beyond maintenance into planning and logistics. When chains are linked with telematics, fleets gain a more precise understanding of how often and where traction devices are deployed. Managers can correlate chain usage with weather events, road conditions, and route profiles to optimize deployment strategies. For example, in urban or suburban corridors that experience frequent snow events, data-driven decision rules can prioritize quick-release, easy-to-deploy designs that minimize driver labor and vehicle downtime during repeated cycles of snow and thaw. In long-haul operations, the pattern may favor heavier-duty configurations that balance peak capability with robust wear characteristics over extended routes. The overarching effect is a more resilient winter-operating model that can adapt as weather patterns shift.

The market is also increasingly mindful of sustainability goals. Environmental considerations are shaping material choices and design approaches. Lighter chain configurations made from high-strength alloys or composite materials can deliver meaningful weight reductions without sacrificing the durability needed for heavy commercial use. In practice, even modest weight reductions translate into improved fuel efficiency and lower emissions over a fleet’s lifecycle. Recyclable components and modular subassemblies support a circular approach to maintenance and retirement, aligning with broader corporate sustainability initiatives while helping fleets manage total cost of ownership. The emphasis on lighter yet capable designs reinforces a core message: durability does not have to come at the expense of efficiency or environmental responsibility.

Regulatory dynamics are a persistent driver of product development and market expectations. In North America and Europe, safety standards and winter-traction requirements are tightening, pushing manufacturers to raise performance floor levels. Jurisdictional updates, including new or revised guidelines for emergency equipment and traction devices, influence which designs are favored or mandated for specific fleets and service sectors. Certification programs that evaluate and standardize testing metrics contribute to a more transparent marketplace, helping operators compare options with greater confidence. In parallel, regulatory attention to emissions and energy use nudges innovation toward systems that perform reliably while consuming fewer resources. This convergence of safety, efficiency, and accountability creates a compelling incentive for fleets to adopt next-generation chain systems rather than sticking with older, purely mechanical solutions.

The diversity of applications continues to grow as manufacturers tailor chains to unique use cases. Heavy-haul operations demand high-speed stability and unwavering durability under continuous load. Urban delivery fleets prioritize quieter operation, rapid deployment, and compact form factors that fit into tight maintenance windows and restricted urban environments. Multi-terrain systems are catching on in regions where snow, ice, mud, and gravel intersect with mixed-route logistics. The common thread across these differentiated offerings is that customization is no longer a luxury but an operational necessity. Fleets that maintain mixed fleets or traverse diverse geographies gain a practical advantage from systems designed with cross-scenario performance in mind.

Digital marketplaces and the broader e-commerce shift are reshaping how fleets source and service traction systems. Procurement is increasingly accelerated by online catalogs, side-by-side feature comparisons, and user reviews. Some providers are experimenting with subscription or as-a-service models for chain maintenance and replacement, aligning costs with usage and weather cycles rather than flat, upfront investments. Augmented reality tools are beginning to help fleet managers visualize how specific chain configurations will fit particular tires and mounting setups before a purchase, reducing misfits and post-sale surprises. In short, the buying process is becoming as strategic as the engineering choices themselves, with data and visualization tools supporting better decision-making.

As the market evolves, one can observe how the convergence of durability, adaptability, and intelligent design is redefining what “best-in-class” means for commercial semi-truck tire chains. It is less about a single, unassailable product and more about a spectrum of options that can be tuned to an operator’s unique risk tolerance, duty cycle, and weather exposure. For stakeholders watching these shifts, the message is clear: invest in traction technology that pairs robust physical performance with the capabilities to monitor, adapt, and learn from real-world use. That combination promises not only safer journeys and lower operating costs but also a more resilient supply chain for goods that move across continents and climates.

For readers exploring regulatory and industry context, see the discussion on how OEMs are seeking clarity in emissions regulations, which underscores the broader alignment between vehicle systems and traction devices. OEMs seek clarity in emissions regulations.

For a broader sense of how these trends fit into the global automotive landscape and the emphasis on forward-looking strategies, consult the external industry outlook at PwC. The Global Automotive Outlook 2026 provides a framework for understanding how innovations in traction technology intersect with fleet economics, safety policy, and environmental targets: https://www.pwc.com/gx/en/industries/automotive.html

Traction Mastery: How the Newest Commercial Semi-Truck Tire Chains Elevate Safety, Compliance, and Fleet Efficiency

Traction is not a luxury in long-haul operations; it is a core driver of safety, schedule adherence, and cost control across a fleet. As the winter months extend into longer windows and storms become more severe in transcontinental routes, the newest commercial tire chains are designed not just to grip but to integrate with broader fleet strategies. The latest generation leans into durability, versatility, and predictable performance, with features that reflect the realities of modern trucking: mixed fleets, tight maintenance windows, and the need to keep trailers and loads moving while complying with evolving safety standards. The result is less a gadget and more a system that links traction, driver training, vehicle maintenance, and regulatory compliance into a cohesive practice that fleets can rely on when the road turns slick.

At the heart of this evolution is durability. The most sought-after chains today are marketed as heavy-duty, thickened, and reinforced. These descriptors signal something more than surface toughness: a design philosophy that anticipates the stress points of a commercial semi-truck. Large commercial vehicles subject chain assemblies to repeated flexing, high loads, and cold brittle steel in subzero conditions. The newest options address these realities by using high-strength steel alloys and reinforced cross-links that resist wear from curbs, heavy road salt, and rough pavement. The upshot is chains that hold their shape and tension longer, reducing the frequency of inspection stops and the risk of unexpected loosening or breakage during a critical pass through mountain passes or frozen corridors.

Another defining feature is coverage. Enclosed-style or fully protected chains have gained traction as a practical way to improve grip while protecting both the chain and the wheel from debris and damage. An enclosed design minimizes the exposure of individual chain elements to road spray, ice, and corrosive salt, while also providing a more predictable engagement across a tire’s circumference. For fleets that run in neighborhoods with variable snow banks or slushy shoulder-byways, this design translates to fewer surprises when the vehicle is re-entering open lanes after a descent or ascent. The enclosed approach also reduces the likelihood of foreign objects lodging in the chain, a factor that can otherwise derail a trip or necessitate a roadside patch job in less-than-ideal conditions.

Versatility is the other pillar in the current market. A growing share of fleets operates mixed tire inventories—from larger drive tires to regional and local trailers—so universal-fit chains are increasingly favored. These sets promise compatibility with a broad range of sizes, reducing the need to keep multiple specialized chains in stock. The benefit is not only lower upfront cost but also simplified maintenance and faster deployment when a driver encounters a change in equipment on a trip or across a seasonal fleet refresh. The practical reality is clear: a universal-fit solution that remains robust under high loads helps an operator minimize downtime during winter weeks when every minute matters for on-time delivery schedules. As fleets consider capitalization and lifecycle costs, universal designs become less about one-to-one matching and more about predictable performance under varied operating conditions.

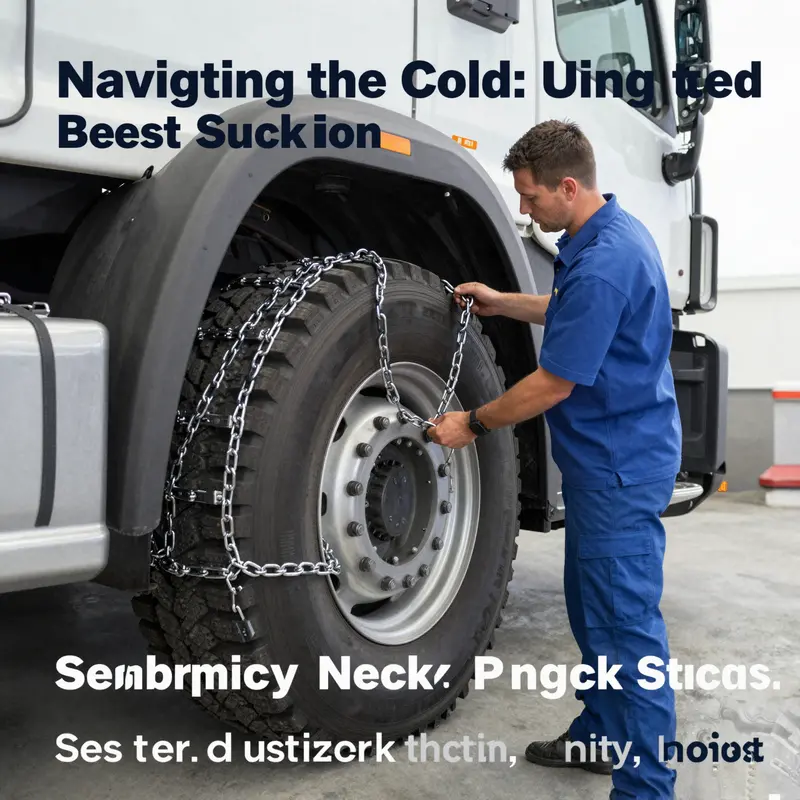

Installation remains a critical determinant of real-world performance. Even the strongest chain is only as effective as its installation on the drive axle. Best practice emphasizes mounting on the primary traction axles, typically the rear set, to maximize the transfer of engine torque into wheel grip. The emphasis on the drive axle is not a mere guideline; it reflects physics and the practical demands of maintaining forward momentum on ice and packed snow. Manufacturers’ instructions must be followed to the letter because even carefully designed chains can bind if they are too tight or too loose. The modern trend toward more sophisticated tensioning systems—cam-tighteners and quick-release mechanisms—helps drivers achieve the correct tension quickly, with a minimum of stringency that could otherwise lead to chatter, binding, or slippage. Training becomes more than a one-time session; it evolves into a standard operating procedure that drivers reference before every winter run.

Safety in operation also hinges on behavior behind the wheel. Once chains are in place, the driving mode changes. Speed reductions, smoother throttle transitions, and careful braking transitions reduce the chance of excess chain wear or a departure from the wheel path that could result in a loss of traction. The guidance is practical: maintain a conservative speed, increase following distance, and avoid abrupt maneuvers that could pry the chain links loose from the tire or pull the chain across the tread in a way that accelerates wear. These behavioral adjustments, paired with robust hardware, create a safety belt that protects the driver, the load, and the other road users.

Maintenance and periodic checks remain nonnegotiable. The chains should be inspected before use for broken links, bent connectors, and any visible fatigue in the links. Tire tread depth matters too; chains are a traction aid, not a substitute for proper winter tires. After deployment on a snowy or icy surface, drivers should recheck tension and general condition once conditions allow a safe stop. Road miles, rough terrain, and contact with raised curbs can all alter the chain’s fit. Once the road conditions improve, chains should be removed promptly to prevent unnecessary wear on both the tire and the road surface. Storage after use should be meticulous: clean off salt and debris, dry thoroughly, and store in a dry place to slow rust and corrosion. A routine that pairs pre-use inspection, correct sizing, careful installation, prudent driving, and post-use maintenance creates a lifecycle that keeps the equipment in service and ready for the next winter window.

The procurement lens is increasingly shaping what fleets consider “best.” The newest chains are not merely hardware; they are components of a larger risk-management and cost-control strategy. When fleets evaluate options, they weigh the durability and coverage against the complexity of installation and the ease of maintenance. A set that reduces the number of different chain sizes in stock simplifies purchasing, reduces the risk of mismatched components, and lowers the risk of delays due to missing parts on the road. The economics also extend to liability and warranty coverage. Heavier, reinforced designs that perform over longer service lives can translate to fewer roadside calls, smaller fuel penalties associated with idle time, and better adherence to delivery commitments. In this sense, the best option for a given fleet is one that aligns with its operational profile—the mix of routes, the typical winter severity in its regions, the age and type of its equipment, and the company’s tolerance for maintenance work on the road versus in a shop.

The decision framework for choosing among the newest chain designs also reflects how market dynamics influence procurement. Fleets monitoring economic trends and order flows, including shifts in trailer and tractor demand, may find that investment in high-durability, universal-fit chains offers more predictable performance and easier fleet-wide deployment than a portfolio of specialized options. This is especially relevant for operators with mixed fleets or seasonal fluctuations in equipment. For those looking to connect broader industry context to their chain strategy, recent analyses of trucking economic trends affecting trailer orders provide a useful lens for aligning capital expenditure with anticipated capacity needs and maintenance windows. See the discussion here: trucking economic trends affecting trailer orders.

As fleets weigh these considerations, it remains essential to couple hardware choices with regulatory awareness. The path between road conditions and fast, compliant operations is paved by a driver’s ability to deploy the right tool quickly, adhere to legal requirements, and maintain a conservative operating posture when conditions demand it. Standards established by federal and state authorities guide when chains may be used, the maximum safe vehicle speeds with chains engaged, and when chain removal is required as conditions improve. The U.S. Department of Transportation and state transportation departments publish updated safety standards and regulations to help operators stay compliant without sacrificing performance. For authoritative information on commercial truck safety and chain usage, see the USDOT guidance at https://www.transportation.gov.

In practice, the newest commercial tire chains become a force multiplier when paired with disciplined driver training, a streamlined maintenance process, and a procurement approach that treats chains as strategic safety and reliability gear rather than one-off accessories. The combination of durable, enclosed, or universal-fit designs with robust installation protocols creates a system that supports safer winter operations, minimizes downtime, and sustains on-time performance across a fleet. It is not a single silver bullet, but a balanced, integrated approach that aligns with the realities of modern trucking—where the road, the load, and the schedule demand dependable traction, every mile of the way. The best practices outlined here—pre-use inspection, correct sizing, drive-axle installation, cautious driving, regular tension checks, appropriate removal timing, and thoughtful storage—form a cohesive discipline. In the end, traction becomes a measurable fixture of fleet performance, not a matter of chance when winter storms arrive.

Toward Safer, Lighter Giants: The Next Wave of Commercial Semi-Truck Tire Chain Innovations

The road to safer, more efficient winter operation for commercial fleets is gradually being reshaped by a trio of converging innovations. As snow and ice become routine tests for big rigs across cross-border corridors and northern arterials, the industry is turning toward tire chains that are lighter, stronger, and smarter. This shift is not simply about making chains that grip better in a storm; it is about reimagining how fleets deploy, monitor, and maintain traction in a way that preserves fuel efficiency, reduces wear on heavy suspensions, and shortens the time trucks spend stationary in harsh weather. The market signals guiding this evolution are clear. The combined pressures of heavier loads, longer route cycles, and the imperative to minimize downtime push manufacturers toward solutions that deliver consistent performance under stress while remaining practical for everyday fleet use. In this sense, the next generation of commercial tire chains is less a single device and more a system upgrade—one that blends advances in materials, manufacturing precision, and digital insight to transform a winter liability into a controlled, data-driven operation.

Material science lies at the heart of this transformation. One of the defining moves is toward high-strength, lightweight alloys and reinforced composites. Traditional steel links, while rugged, add weight and invite wear in cold temperatures. The emerging approach explores alloys and composite blends that maintain grip without adding the bulk that slows deployment or taxes the vehicle’s suspension. For fleets, the payoff is tangible: reduced overall mass translates to better fuel efficiency and less dynamic strain on steering and axles during harsh weather. In environments where every mile counts, even a modest drop in chain weight compounds into meaningful gains over a winter season. These materials also contribute to longer chain life under repetitive fatigue, a critical factor when chains ride along exposed wheel wells through freezing rain, salted roadways, and subzero wind chills. The trend is not merely about making chains lighter; it is about preserving integrity in extremes. Heavier-duty applications, such as those on large semi-trucks transporting dense loads, may still rely on reinforced, robust link configurations, but with optimized alloys or hybridized materials that resist micro-cracking and wear in grit-laden slush.

Manufacturing advances are accelerating the consistency and speed with which these next-gen chains can be produced and deployed. Precision casting techniques and automated assembly lines reduce variability between links and joints, which, in turn, lowers the odds of chains failing under load. Consistency matters profoundly for fleets that operate in tightly scheduled routes and must respond quickly when a storm hits. The ability to achieve uniform wire diameters, uniform link shapes, and predictable wear patterns means maintenance crews spend less time diagnosing unexpected chain behavior in the field. Automated workflows also enable fleets to stock more reliable, ready-to-deploy chains. When winter weather arrives with urgency, faster deployment isn’t a luxury; it’s a safety essential. The combination of precise manufacturing and modular designs can shorten the time from inspection to engagement, allowing drivers to reach grip quickly without sacrificing quality or safety.

A growing portion of the innovation today also centers on smart integration. The most forward-looking chains begin to behave like an extension of the truck’s safety and fleet-management ecosystem. Embedded sensors are envisioned to monitor tension, wear, and even subtle road-condition indicators while the vehicle is in motion. Real-time data streams could be fed into fleet-management platforms, enabling proactive maintenance and dynamic deployment decisions. Picture a scenario in which a chain’s tension drifts as a wheel spins up, or wear accelerates after a stretch of salt-covered pavement. In such cases, the system could trigger a maintenance alert, adjust a planned service window, or route the vehicle to a safe-haven depot for inspection before fatigue safety becomes a risk. The potential benefits go beyond safety. With sensors and connected data, fleets can optimize inventory by predicting spare-chain needs, calibrating tensioning procedures for different tire sizes, and coordinating support responses during storms. The future, in short, envisions tire chains not as a passive accessory but as an intelligent, responsive component of a broader winter operations strategy.

In the market context, these technological threads align with a broader push toward universal fit and durability. Operators running mixed fleets—trucks, vans, and lighter duty semis—seek solutions that can cover a range of tire sizes with a single, reliable system. The appeal of universal or semi-universal chains is clear: reduced procurement complexity, lower stocking costs, and faster response times in snow emergencies. At the same time, the design emphasis remains squarely on durability. Heavy-duty, thickened, and reinforced chain configurations continue to be the baseline expectation in commercial applications, as the weight and stress profile of modern freight movement demand resilience. Yet even within that robust framework, the path forward is one of refinement rather than reinvention. The goal is not to replace proven heavy-duty designs but to enhance them with materials that resist deformation, links that resist corrosion from road salts, and mechanisms that resist sifting sand and ice that can undermine grip.

The commercial snow-chain market’s momentum supports this optimistic outlook. A growing body of data indicates a sustained demand for superior traction solutions in harsh winter environments, with market analysts projecting continued expansion over the next decade. This context matters for operators who must balance upfront capital with long-term reliability. For fleets, the allure of smarter, lighter, and more durable chains translates into fewer roadside interventions, shorter chain-installation times, and a reduced chance of on-road failures during critical transit windows. The convergence of material innovation, precision manufacturing, and sensor-enabled intelligence is not a speculative prospect but an industry trajectory reinforced by ongoing R&D investments and the willingness of carriers to optimize winter safety as a strategic operational priority. As designers refine the balance between strength and weight, between universal fit and specialized performance, the end result will be a family of chains that can be confidently deployed in a wider range of weather conditions and tire configurations without sacrificing efficiency or safety.

For readers who want to place these developments in a broader industry frame, the conversation about future chains is closely linked to how fleets allocate resources under pressure. The decisions around stocking, maintenance scheduling, and response times during storms are shaped by market signals and by the practical realities of cross-border operations, fuel economy targets, and regulatory expectations. A practical entry point into this larger discourse can be found in analyses that explore how ongoing shifts in trailer and equipment orders influence overall margins and capacity planning. Trailer Orders Impact Truckload Margins offers a window into how equipment choices ripple through operations during peak seasons, underscoring why a resilient, serviceable, and data-informed tire-chain solution matters as a strategic asset rather than a simple safety appendage.

Looking ahead, the industry’s ambition is clear: to deliver tire chains that are safer in the worst conditions, easier to deploy in the moment of need, and more intelligent about wear, tension, and life-cycle costs. This triad of aims—material strength with lightness, manufacturing precision with reliability, and smart integration with fleet data—points toward chains that can be trusted to perform consistently at scale. It also suggests a broader ecosystem in which winter traction becomes a measurable parameter of fleet efficiency, not just a seasonal hazard to be endured. If these strands hold, the next decade could see commercial chains that reduce fuel penalties associated with heavy equipment weight, minimize downtime during snow events, and provide operators with actionable insights that turn a tactical response into a strategic advantage. In the end, the evolution of tire chains mirrors the broader freight industry’s own journey: a move from brute resilience toward intelligent resilience, where every link contributes to safer, more efficient, and digitally coordinated winter operations.

External perspective: for a comprehensive market context and future outlook, see Grand View Research’s in-depth analysis of the Commercial Truck Snow Chain market: https://www.grandviewresearch.com/industry-analysis/commercial-truck-snow-chain-market

Final thoughts

In conclusion, the landscape of commercial semi-truck tire chains is rapidly evolving, with noteworthy developments that cater to the rigorous demands of the logistics and freight industries. By understanding the best and newest options available, as well as key features and market trends, companies can make informed decisions that significantly enhance their operational efficiencies. Best practices for utilization will ensure that businesses maximize the benefits of these products, while future innovations promise to continue pushing the boundaries of safety and performance in adverse conditions.