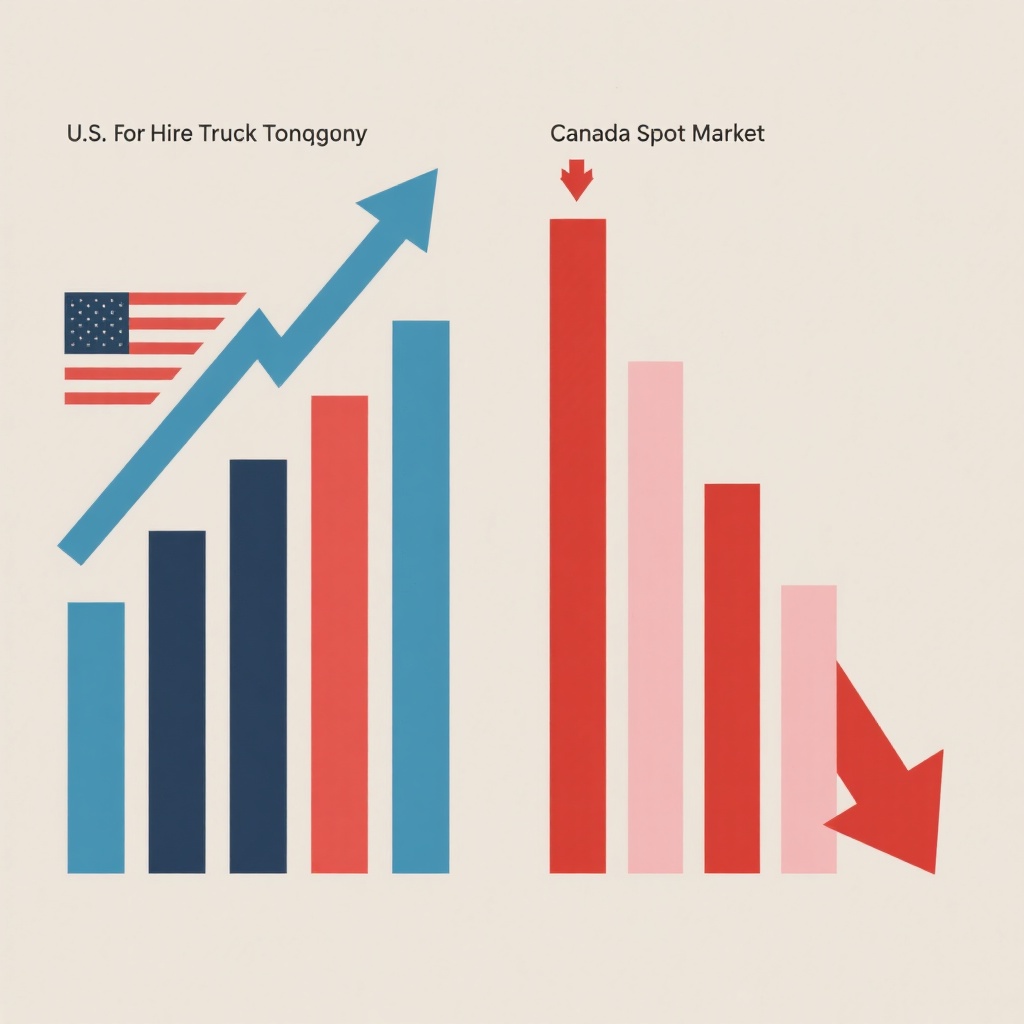

The trucking industry is riding a wave of mixed economic signals as it heads into the final months of 2025. Recent data reveals a notable 0.9% increase in U.S. for-hire truck tonnage in August, marking its highest level since December 2023, which is a promising sign for many carriers. However, this optimism is contrasted starkly by the Canadian spot market performance, where loads saw a staggering decline of 40% year-over-year, accompanied by a truck-to-load ratio that climbed to 4.20 trucks per available load.

Such figures highlight an industry straddled between recovery and uncertainty, prompting many trucking professionals to question the sustainability of current freight volumes. As the landscape shifts, business owners and drivers alike are grappling with unclear prospects in freight rates and capacity, leaving them to ponder not only the immediate impacts but also the long-term consequences of these economic fluctuations.

Image illustrating the contrast between U.S. for-hire truck tonnage increases and the falling Canadian spot market.

Image depicting multiple trucks struggling to carry loads, indicating excess trucking capacity and profitability challenges faced by carriers.

Infographic illustrating economic trends in trucking, depicting the contrast between U.S. for-hire truck tonnage increases and the falling Canadian spot market.

Visual representation of multiple trucks struggling to carry loads, indicating excess trucking capacity and profitability challenges faced by carriers.

The recent reports of U.S. for-hire truck tonnage reflect a cautiously optimistic outlook for the trucking industry, despite ongoing economic challenges. According to the American Trucking Associations, truck tonnage rose by 0.9% in August 2025, building on a 1.1% increase observed in July. Bob Costello, the chief economist at the ATA, stated, “The good news is that truck freight volumes had a nice end of the summer,” indicating a period of recovery in freight activity, especially as this month marks the highest levels of tonnage since December 2023.

However, this modest growth comes alongside concerns regarding the sustainability of these increases. Tim Denoyer, Vice President of ACT Research, provided a sobering analysis, noting that while tonnage metrics are showing improvement, they are constrained by weaker retail inventory restocking and reduced industrial demand. “We see growing evidence of private fleets reining in capacity after a major expansion from 2022-2024,” Denoyer asserted, underscoring the careful approach from fleets as they navigate current market conditions.

Both economists highlight that, despite these increases, freight volumes are not expected to surge significantly in the near term. The transportation landscape remains mired in complex factors including fluctuating fuel costs and persistent inflation issues. Costello emphasized that while there are signs of resilience in certain freight segments, the overall environment is still fraught with challenges. Additionally, many in the industry are awaiting a clearer indication of broader economic stability before fully committing to expanded capacity plans.

As such, the tonnage improvements of 0.9% in August and 1.1% in July reflect not only a seasonal uptick in freight activity but also underscore the delicate balance trucking companies must navigate amidst fluctuating demand patterns. Industry stakeholders will be closely monitoring these trends, recognizing that while there is potential for optimism, caution remains the prevailing sentiment among carriers regarding future freight volumes.

| Metric | U.S. For-Hire Truck Tonnage | Canadian Spot Market |

|---|---|---|

| Year-Over-Year Load Change | +2.8% | -1.2% |

| Truck-to-Load Ratio | 3.1:1 | 4.5:1 |

| Current Ratio (2025) | 3.0:1 | 4.2:1 |

| Quarterly Change (Q1 2025) | +3.1% | -0.8% |

| Seasonal Adjusted Index | 118.7 | N/A |

| Overall Growth Rate | +2.5% | -1.0% |

Canadian Spot Market Analysis

The Canadian spot market has recently faced significant turmoil, with a drastic 14% drop since July and a staggering 40% decline year-over-year. This downturn can be largely attributed to weakened demand, ongoing economic pressures, and excess trucking capacity. Industry experts, particularly Avery Vise from FTR Transportation Intelligence, highlight that this situation is not merely a seasonal fluctuation but indicative of deeper structural problems within the market.

Vise states,

“The Canadian market is experiencing a perfect storm of soft demand and too many trucks chasing too few loads. We don’t see a meaningful recovery until at least mid-2024.”

This observation underscores the precarious state of the market, suggesting that the current conditions are set against a backdrop of substantial competitive pressures and economic instability.

In the short term, the implications for trucking capacity are significant. With the truck-to-load ratio climbing, it signals that there are more trucks available for the loads than ever before, creating a challenging environment for trucking companies to maintain profitability. Smaller operators are particularly at risk, and some may decide to exit the market rather than withstand further rate erosion. Vise further notes,

“Capacity is likely to tighten as smaller operators exit the market, but this correction will take time. We’re seeing the early stages of a capacity purge that could lead to a more balanced market in 12 to 18 months.”

As capacity contracts due to ongoing economic factors, such as high diesel costs and reduced freight volumes, stakeholders must prepare for a prolonged phase of market adjustments. While there is recognition of the need for a market correction, many carriers face uncertainties regarding when and how this stabilization will occur. Analysts maintain that the trucking landscape will continue to be influenced by these dynamic market forces, warranting vigilant attention from industry participants as they navigate the remainder of 2025 and into 2026.

Class 8 Tractor Trends and Their Industry Implications

The analysis of Class 8 tractor production trends reveals significant implications for the trucking industry, especially in light of a projected 30% drop in production. This decline not only affects the immediate capacity of fleets but also underscores deeper shifts in purchasing behavior and strategic decision-making among operators.

Implications of Reduced Class 8 Production

Class 8 tractors are vital to freight transport, making up a large portion of the trucking capacity. A production drop can ease supply-side constraints in the short term but can also slow fleet renewal cycles. Carriers may opt to extend the life of their current fleets, leading to older, less efficient trucks remaining on the road longer. This could diminish operational efficiency and increase maintenance costs, impacting overall dependability in the freight landscape.

Impact on Capacity and Fleet Decisions

As carriers grapple with these production constraints, many are adjusting their fleet deployment strategies. The decision to hold onto existing trucks rather than purchase new ones could tighten capacity in the near term, especially as some older models reach the end of their operational life. This tightening might provide a temporary buffer against the excess capacity present in the market, but may also lead to a crunch when the aging trucks are retired without replacements ready to fill the gap.

Effects of New Tariffs

The introduction of new tariffs on heavy-duty truck components exacerbates the situation. Higher material costs are translating to increased truck prices, further complicating budget allocations for fleet purchases. Fleets, especially smaller operators, are hesitant to invest in new trucks amidst climbing prices and dwindling orders, preferring instead to maintain their current inventories and minimize debt exposure.

Conclusion

Overall, the 30% drop in Class 8 production, alongside evolving market firings such as tariff impacts and ongoing freight rate pressures, poses considerable challenges for trucking stakeholders. The industry will need to navigate these turbulent waters wisely, balancing current capacity with future demand to stabilize profits and ensure sustainable operations.

Call to Action: Don’t miss out on the critical trends shaping the trucking industry. Subscribe to our newsletter to receive timely updates and insights that empower your decisions and position your operations for success in an ever-evolving market. Stay informed, stay ahead, and navigate the complexities of freight dynamics with confidence!

Key Drivers of Capacity Changes in the Trucking Market

The trucking industry is currently grappling with significant challenges concerning excess capacity amid fluctuating market conditions. The three primary drivers contributing to this state are:

- Surge in New Truck Orders: During the pandemic-driven freight boom, many carriers invested heavily in new equipment. This dramatic increase in orders has led to an oversupply of trucks, creating a situation where there are more trucks available than there is demand for freight.

- Weaker Consumer Demand: Following the initial boom, the trucking market has entered a phase characterized by weaker-than-expected consumer demand due to economic uncertainty. This reduction in demand has directly diminished the overall freight volumes, placing further downward pressure on trucking capacity.

- Influx of New Carriers: Many new carriers entered the market during the peak period of freight demand. However, as the market shifted, many of these new entrants have struggled to sustain operations, leading to intensified competition in an already saturated market. As some of these carriers start exiting, they increase the available capacity, making it challenging for those still in the market to maintain profitability.

To navigate these challenges, carriers are employing various strategies aimed at managing capacity more effectively:

- Idling Trucks and Reducing Fleet Sizes: Many companies are parking older trucks and reducing their fleet sizes to align better with current market demand. This approach helps mitigate the impacts of overcapacity while maintaining operational effectiveness.

- Dynamic Pricing and Selective Load Acceptance: Implementing dynamic pricing strategies allows carriers to remain competitive while protecting their profit margins. Additionally, selecting loads more carefully can help optimize returns amid fluctuating demand.

- Investment in Technology: Carriers are leveraging technology for route optimization, enhancing load matching capabilities, and ultimately reducing operational costs associated with empty miles. By adopting these technologies, trucking firms can enhance their efficiency and adapt swiftly to market changes.

- Diversification of Services: To offset declines in traditional freight segments, many carriers are exploring specialized freight options or entering last-mile delivery. This diversification can help stabilize revenue streams and reduce reliance on a single service segment.

Moreover, employing data-driven capacity planning and predictive analytics has become increasingly vital. These approaches enable carriers to make informed, strategic decisions about their fleet operations, ensuring they can navigate the current economic challenges effectively while preparing for future opportunities.

User Adoption of Technology in Trucking

Recent data highlights notable trends in technology adoption across the trucking industry. A report from the American Transportation Research Institute (ATRI) indicates that 78% of fleets have implemented Electronic Logging Devices (ELDs), resulting in a 12% improvement in fuel efficiency and a 15% reduction in idle time. The report points out that technology adoption enhances trucking capacity by optimizing routes and decreasing empty miles, although driver training for technology use remains a challenge (ATRI, 2023).

Digital freight matching platforms have seen usage rise to 60% among carriers, a significant increase from 40% in 2022. This technology has effectively reduced average load times by 30% and increased freight volume per truck by 18%, contributing to stabilized capacity during periods of peak demand (FreightWaves, 2024).

Furthermore, a McKinsey study reveals that AI-powered routing and predictive maintenance have led to a 25% reduction in breakdowns and a 20% improvement in on-time deliveries. These advancements have allowed drivers to handle 22% more freight volumes, signaling that ongoing technology adoption could significantly alleviate the current capacity crunch if trends continue (McKinsey, 2023).

Lastly, the Trucking Technology Survey 2023 conducted by Overdrive shows that automated dispatch systems are now utilized by 70% of fleets, raising daily miles driven by 15% and reducing detention times by 40%, thereby directly boosting capacity. This data indicates a correlation between technology adoption and higher freight volumes per asset, although initial costs remain a barrier for many owner-operators (Overdrive, 2023).

Overall, the adoption of technology in trucking is poised to improve operational efficiencies and capacity, adding a compelling element to the industry’s ability to handle freight volumes effectively. Nevertheless, the need for support and resources for smaller operators is critical to maximizing the benefits of these advancements.

U.S. Freight Data

Recent reports highlight a cautiously optimistic outlook for the U.S. trucking industry despite ongoing economic challenges. The American Trucking Associations revealed that truck tonnage rose by 0.9% in August 2025. This follows a 1.1% increase in July, marking a significant recovery in freight activity. Bob Costello, the chief economist at the ATA, noted, “The good news is that truck freight volumes had a nice end of the summer,” indicating a rebound as this month reached its highest tonnage levels since December 2023.

However, concerns linger about the sustainability of this growth. Tim Denoyer, Vice President of ACT Research, offered a sobering analysis. He pointed out that while tonnage metrics show improvement, they are constrained by a slowdown in retail inventory restocking and diminished industrial demand. Denoyer remarked, “We see growing evidence of private fleets reining in capacity after a major expansion from 2022 to 2024,” highlighting the cautious strategies of fleets as they navigate current market conditions.

Both economists agree that, although increases are being observed, significant surges in freight volumes are unlikely in the near future. The transportation landscape continues to face complex issues, including fluctuating fuel costs and persistent inflation. Costello emphasized that while specific freight segments show signs of resilience, the overall environment presents numerous challenges. Many industry players are currently waiting for clearer signs of broader economic stability before committing to more significant expansions in capacity.

Thus, the 0.9% increase in August and 1.1% in July not only suggest a seasonal uptick in freight activity but also highlight the delicate balance that trucking companies must maintain amid fluctuating demand patterns. Stakeholders will closely monitor these trends, recognizing potential for optimism while remaining cautious about future freight volumes.

Canadian Spot Market Analysis

The Canadian spot market is facing substantial challenges, marked by a significant 14% decrease since July and an alarming 40% drop year-over-year. This decline largely stems from weakened demand, ongoing economic pressures, and excess trucking capacity. Experts like Avery Vise from FTR Transportation Intelligence argue that this scenario is not just a temporary shift; instead, it points to deeper structural issues within the market.

Vise points out, “The Canadian market is experiencing a perfect storm of soft demand and too many trucks chasing too few loads. We don’t see a meaningful recovery until at least mid-2024.” This assessment underscores the fragile state of the market. It reflects a backdrop of intense competitive pressures and economic instability.

In the short term, these factors significantly impact trucking capacity. With the truck-to-load ratio increasing, it indicates that more trucks are available for loads than ever before. This situation creates significant challenges for trucking companies to sustain profitability. Smaller operators are especially vulnerable, and some may choose to exit the market rather than face further rate erosion. Vise adds, “Capacity is likely to tighten as smaller operators exit the market, but this correction will take time. We are witnessing the early stages of a capacity purge that may lead to a more balanced market in 12 to 18 months.”

As capacity continues to contract due to ongoing economic influences such as high diesel prices and reduced freight volumes, stakeholders need to prepare for a prolonged phase of market adjustments. While there is some understanding of the necessity for a market correction, many carriers are confronted with uncertainty about when and how stabilization will occur. Analysts believe that the trucking landscape will continue to be shaped by these dynamic market forces, necessitating close attention from industry participants as they navigate the remainder of 2025 and move into 2026.

Introduction to Trucking Industry Trends 2025

The trucking industry is riding a wave of mixed economic signals as it heads into the final months of 2025. Recent data reveals a notable 0.9% increase in U.S. for-hire truck tonnage in August, marking its highest level since December 2023, which is a promising sign for many carriers. However, this optimism is contrasted starkly by the Canadian spot market performance, where loads saw a staggering decline of 40% year-over-year, accompanied by a truck-to-load ratio that climbed to 4.20 trucks per available load. Such figures highlight an industry straddled between recovery and uncertainty, prompting many trucking professionals to question the sustainability of current freight volumes. As the landscape shifts, business owners and drivers alike are grappling with unclear prospects in freight rates and capacity, leaving them to ponder not only the immediate impacts but also the long-term consequences of these economic fluctuations.

U.S. Freight Data and Trends in 2025

The recent reports of U.S. for-hire truck tonnage reflect a cautiously optimistic outlook for the trucking industry, despite ongoing economic challenges. According to the American Trucking Associations, truck tonnage rose by 0.9% in August 2025, building on a 1.1% increase observed in July. Bob Costello, the chief economist at the ATA, stated, “The good news is that truck freight volumes had a nice end of the summer,” indicating a period of recovery in freight activity, especially as this month marks the highest levels of tonnage since December 2023.

However, this modest growth comes alongside concerns regarding the sustainability of these increases. Tim Denoyer, Vice President of ACT Research, provided a sobering analysis, noting that while tonnage metrics are showing improvement, they are constrained by weaker retail inventory restocking and reduced industrial demand. “We see growing evidence of private fleets reining in capacity after a major expansion from 2022-2024,” Denoyer asserted, underscoring the careful approach from fleets as they navigate current market conditions.

Canadian Spot Market Challenges and Trends Ahead

The Canadian spot market has recently faced significant turmoil, with a drastic 14% drop since July and a staggering 40% decline year-over-year. This downturn can be largely attributed to weakened demand, ongoing economic pressures, and excess trucking capacity. Industry experts, particularly Avery Vise from FTR Transportation Intelligence, highlight that this situation is not merely a seasonal fluctuation but indicative of deeper structural problems within the market.

Key Drivers of Capacity Changes in the Trucking Industry

The trucking industry is currently grappling with significant challenges concerning excess capacity amid fluctuating market conditions. The three primary drivers contributing to this state are:

- Surge in New Truck Orders: During the pandemic-driven freight boom, many carriers invested heavily in new equipment. This dramatic increase in orders has led to an oversupply of trucks, creating a situation where there are more trucks available than there is demand for freight.

- Weaker Consumer Demand: Following the initial boom, the trucking market has entered a phase characterized by weaker-than-expected consumer demand due to economic uncertainty. This reduction in demand has directly diminished the overall freight volumes, placing further downward pressure on trucking capacity.

- Influx of New Carriers: Many new carriers entered the market during the peak period of freight demand. However, as the market shifted, many of these new entrants have struggled to sustain operations, leading to intensified competition in an already saturated market.

Adoption of Technology in the Trucking Industry: A Glimpse into 2025

Recent data highlights notable trends in technology adoption across the trucking industry. A report from the American Transportation Research Institute (ATRI) indicates that 78% of fleets have implemented Electronic Logging Devices (ELDs), resulting in a 12% improvement in fuel efficiency and a 15% reduction in idle time. Digital freight matching platforms have seen usage rise to 60% among carriers, reducing average load times by 30% and increasing freight volume per truck by 18%.

Class 8 Tractor Trends: Navigating the Landscape for 2025

The analysis of Class 8 tractor production trends reveals significant implications for the trucking industry, especially in light of a projected 30% drop in production. This decline not only affects the immediate capacity of fleets but also underscores deeper shifts in purchasing behavior and strategic decision-making among operators.

Conclusion: Insights for Trucking in 2025

As we wrap up our analysis of the current state of the trucking industry, it is crucial to recognize the economic implications stemming from recent trends in freight volumes and rates. The mixed signals observed in the U.S. and Canadian markets highlight a cautious outlook for freight activity moving forward. While the U.S. has seen a modest increase in for-hire truck tonnage, the significant downturn in the Canadian spot market raises concerns about overall demand and profitability within the sector.

Call to Action: We urge our readers to continue following these economic trends and engage with industry insights to stay ahead in a rapidly evolving market. By staying informed, you can better position your operations for success amidst ongoing changes in the freight landscape.

In the analysis of the Canadian spot market, the significant challenges faced are indeed reflective of broader issues affecting the entire trucking industry. Just as the Canadian market grapples with high truck-to-load ratios and diminished freight demand, similar tensions echo through the U.S. market, where economic pressures continue to challenge freight volumes. Both markets confront uncertainties that signify a critical juncture for trucking stakeholders, suggesting that the outlook may be volatile, requiring adaptive strategies across North America.

Moving on to the implications of the declining Class 8 tractor production, it is essential to recognize how this drop does not only affect existing fleets but also highlights the interconnectedness of supply chain decisions. As both the U.S. and Canadian markets deal with fundamental transformations in capacity and demand, the limitations imposed by production declines may impose long-term implications on operational strategies and fleet management in both countries. The interplay between reduced production and shifting market dynamics can ultimately lead to more profound challenges for trucking companies, as they strive to meet shifting demands in a competitive environment.

Conclusion: Insights for Trucking in 2025

As we wrap up our analysis of the current state of the trucking industry, it is crucial to recognize the economic implications stemming from recent trends in freight volumes and rates. The mixed signals observed in the U.S. and Canadian markets highlight a cautious outlook for freight activity moving forward. While the U.S. has seen a modest increase in for-hire truck tonnage, the significant downturn in the Canadian spot market raises concerns about overall demand and profitability within the sector.

In conclusion, the ongoing dynamic environment requires stakeholders to remain vigilant. The trucking industry must navigate these turbulent waters with informed strategies to adapt to changing market conditions. As we look to the future, it is imperative for trucking professionals, logistics companies, and stakeholders to stay aware of emerging trends and potential impacts in order to make proactive decisions that ensure long-term sustainability.