In a controversial move, President Trump has reignited the debate on trade tariffs with his announcement of a 25% tariff on heavy trucks not manufactured in the United States. This bold stance, aimed at bolstering domestic production under the guise of protecting American jobs, threatens to disrupt the already fragile ecosystem of the trucking industry. The implications of the Trump 25% tariff on heavy trucks extend far beyond manufacturer profits and market competition; they cast a long shadow over logistics companies, suppliers, and ultimately, consumers. The impact of trucking tariffs is poised to ripple through the industry, leading to increased operational costs and complex supply chain challenges.

As the industry braces for a significant shift, stakeholders are left wondering whether this protectionist policy will truly serve its intended purpose or merely exacerbate existing challenges. With heavy vehicle import costs rising, the trucking world stands at a pivotal crossroads, necessitating a careful analysis of future outcomes that could reshape both market dynamics and consumer experiences.

Key Facts about the 25% Tariff on Heavy Trucks

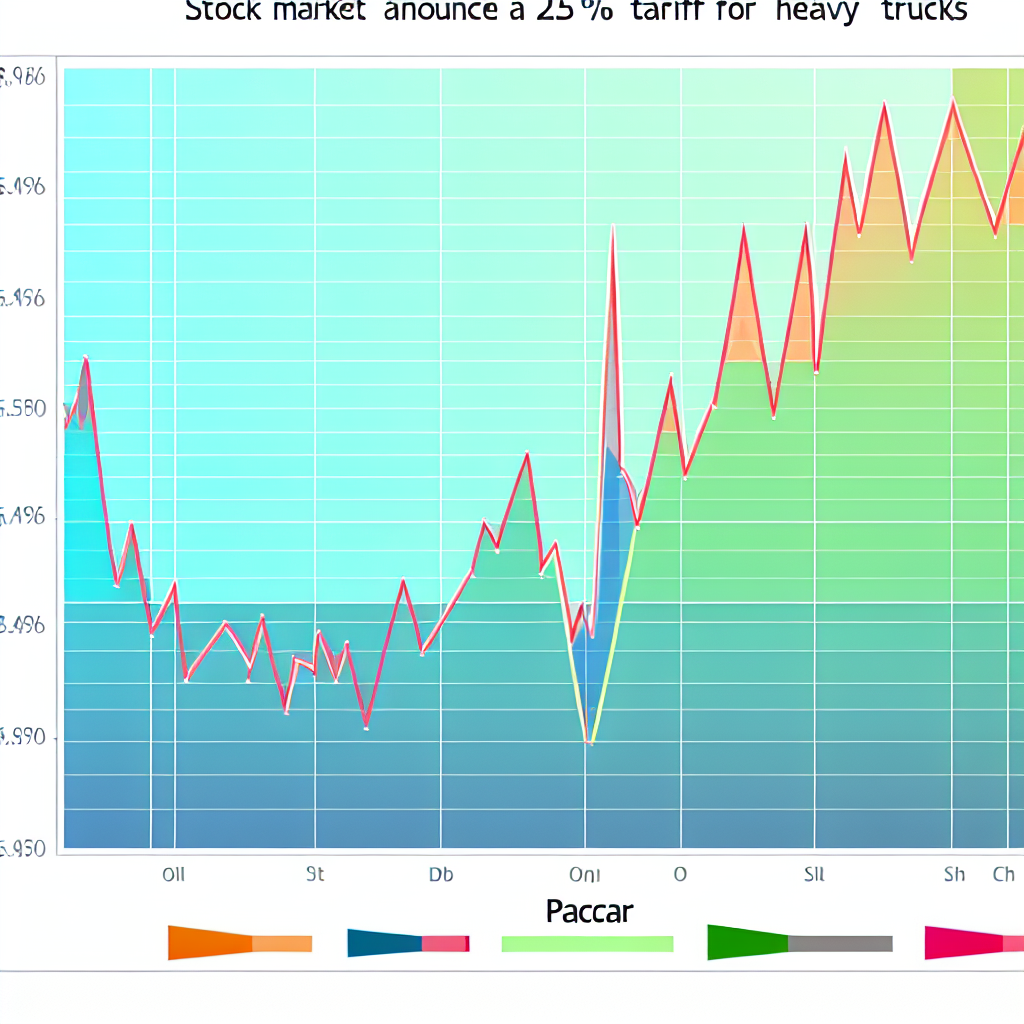

- The 25% tariff is set to take effect on October 1, 2025.

- Paccar shares saw a pre-market increase of 6% following the announcement of the tariff.

- Mack Trucks and Volvo have expressed concerns, highlighting that the new tariff could put them at a disadvantage, particularly due to their reliance on imported components.

- Industry analysts predict this tariff will create significant changes in the dynamics of pricing and competition within the trucking sector.

- The tariff is part of a broader strategy by the U.S. administration aimed at enhancing domestic manufacturing and protecting jobs in the heavy truck sector.

- The American Trucking Associations generally supports the tariff as it could level the playing field for U.S. truck manufacturers.

The 25% tariff on heavy trucks, which is applied to vehicles produced outside the United States, is expected to significantly increase truck prices. This rise in costs will affect not only manufacturers but also logistics and transportation companies, who may be forced to raise freight rates. Eventually, consumers will feel the pinch as these higher costs are passed down the line, leading to more expensive goods and services.

Additionally, domestic truck manufacturers might benefit from reduced competition from imports, encouraging more production within the U.S. However, this increase in domestic output comes with its own challenges. Many companies depend on foreign components for their operations, and the tariffs could create supply chain disruptions and added expenses. Overall, the landscape of the trucking industry will shift, creating both opportunities and hurdles for manufacturers and consumers alike.

| Company Name | Market Share | Tariff Impact |

|---|---|---|

| Mack Trucks | 20% | Significant disadvantage as a major manufacturer |

| Volvo | 15% | Identified competitive challenges due to imports |

| Paccar | 24% | Anticipated increase in stock prices |

| Peterbilt | 12% | Potentially positive impact due to U.S. manufacturing |

| Kenworth | 10% | May benefit from reduction in foreign competition |

| Freightliner | 19% | Increased prices expected, affecting market dynamics |

Trump’s Tariff Announcement on Heavy Trucks

In his announcement of a 25% tariff on heavy trucks not built in the U.S., President Donald Trump stated, “In order to protect our Great Heavy Truck Manufacturers from unfair outside competition, I will be imposing… a 25% Tariff on all ‘Heavy (Big!) Trucks’ made in other parts of the World.” This protectionist policy is positioned as a method to revitalize American manufacturing and create domestic jobs, an argument that resonates with some industry supporters.

However, this move has garnered backlash from key figures within the trucking industry. Chris Spear, President of the American Trucking Associations, criticized Trump’s proposal, declaring it “another arbitrary tax on American consumers” that could potentially undermine the economic benefits realized from the USMCA trade agreement. Spear warned that the tariff would increase equipment costs for trucking companies already facing economic pressures, adding thousands of dollars to the price of each truck.

Peter Voorhoeve, President of Volvo Trucks North America, echoed these sentiments, emphasizing the ripple effects the tariff would have on the supply chain, stating, “Tariffs ultimately increase costs throughout the supply chain and for customers.” Voorhoeve called for a continued commitment to free trade and highlighted the integrated nature of the North American manufacturing ecosystem that relies on current trade agreements.

The contrasting viewpoints illustrate the tension within the industry regarding the anticipated consequences of the tariff, underlying the complexities of balancing protectionism with the realities of a global market.

Conclusion and Future Outlook

The implementation of a 25% tariff on heavy trucks manufactured outside the United States brings forth a myriad of consequences that will resonate throughout the trucking industry and the broader landscape of American manufacturing. Key points from our discussion highlight that while domestic manufacturers stand to gain from reduced foreign competition, the resulting increase in truck prices will inevitably trickle down to logistics companies and, ultimately, consumers. As observed, companies like Mack Trucks and Volvo are already voicing concerns over the negative impacts on their operations due to potential supply chain bottlenecks and increased production costs.

Looking forward, the long-term effects of these tariffs could culminate in a heightened concentration of market dynamics where only the most resilient and innovative companies thrive. The steep tariffs may shield U.S. manufacturers from foreign competition temporarily; however, they also risk fostering complacency, as less competitive products may flood the market without the pressures of global standards. Moreover, the increased costs may deter new entrants into the trucking sector, stifling innovation and technological progress.

As the industry adapts to these changes, stakeholders should carefully consider the balance between protecting American jobs and the potential long-term ramifications of isolationist policies. Tariffs might provide short-term relief, but ultimately, a sustainable path forward for the trucking industry will depend on maintaining a competitive and cooperative global trading environment, which could be jeopardized in the wake of such protectionist measures.

User Adoption of Heavy Trucks and the Impact of Tariffs

The user adoption dynamics for heavy trucks in the U.S. have been notably influenced by the imposition of tariffs. Initially, the tariffs led to a substantial increase in prices, estimated between 10-20%. This price surge notably impacted small and mid-sized fleets, yielding a significant sales drop of approximately 8% from 2019 to 2020. This dip was primarily a direct response to the higher costs associated with imported components and finished trucks, causing many fleet operators to postpone their purchase decisions.

Despite the initial slowdown, a rebound in sales was observed by 2021, thanks in part to increased domestic manufacturing. Producers began ramping up production to minimize reliance on foreign components, ultimately encouraging fleets to update their technologies and integrate newer models. This shift in supply chain strategies indicates a complex relationship between tariffs and user adoption in the heavy truck market.

Furthermore, the tariffs have demonstrated a dual effect: while they can inhibit short-term growth due to increased vehicle costs, they also serve to incentivize necessary updates within the domestic market. The ongoing evolution indicates that stakeholders need to remain adaptable, recalibrating their purchasing strategies while navigating the resulting complexities of the market brought on by protectionist measures. Overall, the long-term outlook suggests a cautious optimism as the market continues to adjust to the impacts of tariffs, paving the way for potential advances in fleet technology and efficiency.

Critical Perspectives on the 25% Tariff on Heavy Trucks

The introduction of a 25% tariff on heavy trucks manufactured outside the United States has provoked a wave of critical responses from various industry stakeholders, who are raising alarm over its potential downsides. Foremost among the concerns is the argument that the tariff will not only increase the costs for American consumers but also adversely impact U.S. jobs in sectors reliant on trucking, logistics, and manufacturing.

Research from the Peterson Institute for International Economics suggests that rather than creating new jobs, the tariffs may actually destroy more jobs in downstream industries, including trucking and construction, than they protect in domestic manufacturing. This assertion highlights a significant risk where protective measures may inadvertently lead to job losses, contradicting one of the primary arguments for imposing the tariffs.

Additionally, the American Action Forum estimates that this tariff represents a $6.8 billion annual tax on the economy. These raised freight costs are likely to be passed on to consumers, leading to higher prices for goods—a burden that falls heaviest on lower-income households who rely on affordable transportation.

Industry executives further reinforce these concerns, stating that delayed equipment purchases resulting from increased costs will stifle growth and hinder job creation across the trucking and manufacturing sectors. The complex interplay of these factors casts a long shadow over the beneficial intentions behind the tariff, suggesting that stakeholders must critically evaluate the broader implications of such protectionist policies.

Key Economic Implications of the 25% Tariff on Heavy Trucks

- The imposition of a 25% tariff is predicted to escalate the prices of heavy trucks, significantly affecting manufacturers and the logistics sector.

- Increased truck prices will likely lead to elevated freight rates, impacting transportation costs across various industries.

- Consumers will eventually bear the brunt of the price hike, as increased operational costs are passed through the supply chain.

- Domestic manufacturers may gain a competitive edge due to reduced import competition, potentially boosting U.S. production in the sector.

- Challenges may arise as many manufacturers rely on foreign components; supply chain disruptions and raised production costs are expected outcomes.

- Tariffs could create a shift in market dynamics, favoring companies with strong domestic production capabilities while challenging those that depend heavily on imports.

- While short-term benefits may be observed in domestic manufacturing, long-term impacts on innovation and pricing strategies need careful consideration.

Outbound Links to Authoritative Sources

For readers seeking to delve deeper into the economic implications of tariffs, the following authoritative sources provide insights into the potential impacts of tariff policies on industries and employment:

- Economic and employment impacts of US tariff strategies – Peterson Institute for International Economics. This article discusses how tariff increases can be counterproductive, potentially reducing GDP and leading to job losses.

- Tariffs lead to hiring freezes and layoffs in US industries – Financial Times via Central Broadcasting Network. This piece highlights the job losses and hiring halts associated with US tariffs, particularly in manufacturing and energy sectors.

- Tariff policies exacerbate US labor market fragility – CNBC via China News Network. An analysis of the rising anxiety among executives and the employment indices indicating negative business conditions exacerbated by tariffs.

- Sectoral resilience and shifts under tariff pressures – DeepSeek Analysis. This article assesses how certain sectors adapt to tariffs and maintain growth through innovation and market diversification.

- Macroeconomic effects of tariffs on growth and employment – CaiXin Research Institute. A study on how tariffs can impact economic growth and employment trends, particularly in China, with implications for global trade.