As the demand for efficient and cost-effective transport solutions increases, understanding where to purchase commercial truck tires wholesale becomes crucial for logistics and freight company owners, construction and mining enterprises, and small business owners managing delivery fleets. The tire market is complex, with various suppliers, regional hubs, and online platforms offering ample options. This article illuminates key areas to consider when sourcing commercial truck tires. From identifying prominent markets and exploring regional wholesale hubs to detailing top direct suppliers and online purchasing platforms, each chapter contributes to an enhanced understanding of the wholesale tire purchasing landscape, empowering readers to make well-informed decisions for their fleet needs.

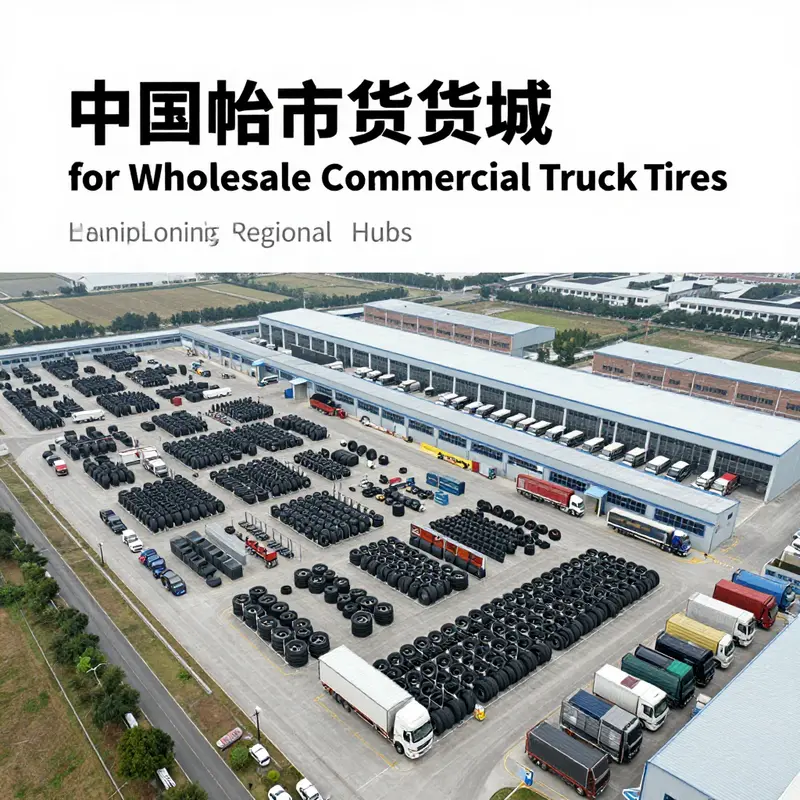

Wholesale Corridors: Navigating China’s Tire Market Hubs for Bulk Truck Tire Purchases

The wholesale landscape for commercial truck tires in China operates like a web of interlocking markets, each node offering distinct strengths for buyers seeking bulk quantities. To understand where to buy wholesale, one must move beyond a single showroom or a generic price sheet. Instead, a buyer travels through a network of hubs, each with its own balance of scale, stock diversity, logistical efficiency, and industry reputation. This network is not random; it is shaped by geography, transportation corridors, and the way distributors have organized themselves to serve long-haul fleets, regional fleets, and everything in between. In practical terms, the journey begins in a traditional boomtown of tire trade—where volume and speed matter most—and extends to regional centers that specialize in budget ranges, stock types, or bespoke services. Taken together, these centers create a nationwide fabric that lets buyers tailor their sourcing to fit fleet needs, maintenance cycles, and cash flow constraints.

If a buyer prioritizes the sheer breadth of options and the fierce price competition that comes from dense supplier clusters, the Zhejiang corridor stands out. Zhejiang’s tire city operates as a magnet for bulk buyers who want the widest possible selection under one administrative roof. The sheer variety—from heavy truck tires of multiple tread patterns to industry-standard casings and compatible rims—creates a marketplace where price discipline is driven by the number of competing sellers. The effectiveness of the Zhejiang hub rests not only on scale but on logistics ecosystems that connect suppliers with freight networks, warehousing facilities, and port access. For a purchaser who needs to replenish an extensive fleet on a monthly rhythm, the Zhejiang market becomes less a single point of sale and more a staging ground for continuous replenishment. The lesson here is less about chasing the lowest sticker price and more about leveraging the cluster effect: more suppliers in proximity means more price transparency, faster stock turnover, and better terms through serious bargaining power born from volume.

The southern capital of manufacturing and distribution—Guangzhou—adds another layer to the wholesale picture. Southern China has long functioned as a gateway to the internal market and to neighboring Southeast Asian routes. In Guangzhou, buyers encounter a spectrum of tire markets that serve regional demand with remarkable efficiency. A central feature is the density of shops and stalls within concentrated zones, where buyers can compare brands, negotiate bulk discounts, and observe live stock flows across a regional network. The logistics advantages are notable: proximity to large river and port facilities, strong trucking corridors, and established service channels for maintenance and immediate after-sales support. For fleets located in the southern provinces or in nearby inland provinces, Guangzhou’s wheel-and-tire ecosystems offer a practical blend of depth and accessibility. The markets here function not only as storefronts but as local logistics hubs, where stockholders coordinate with transport operators to shave days off lead times and to reduce the complexity of cross-dock shipments.

Wuhan anchors central China as a logistics-centric base for professional tire services. The Che Lun Bang Tyre Wholesale Base has developed its identity around a core strength: a sizable, well-curated stockpile in a region with robust transit networks. Buyers here benefit from a focus on commercial vehicle tires and the institutional support that accompanies that focus, including professional services and financial arrangements that ease bulk purchasing. The central location supports a broad catchment area, drawing fleets from across the middle reaches of the country. The emphasis on service and reliability matters for buyers who treat tires as a fleet’s lifeblood; it matters for those who wish to secure not just the product, but the reliability of the supply chain—stock availability during peak seasons, consistent quality across batches, and predictable delivery windows that align with maintenance schedules.

Beyond these cores, a constellation of regional hubs adds specialized angles to the wholesale equation. Anqing in Anhui offers a distinct model with the Jixian Used Car Market, which channels demand toward used tires at budget-friendly price points. For buyers seeking lower upfront costs or lessoning depreciation on older fleets, this market signals a practical option where the total cost of ownership can be managed through careful sourcing choices. Harbin in Heilongjiang presents another specialization cluster, with Lin Di Street hosting numerous tire and rim shops. The geography matters here: northern markets face different seasonal patterns and demand cycles, so the wholesale dynamic adapts to winter performance needs and regional maintenance cycles. Tangshan in Hebei centers around a large cluster near the Second Iron Furnace, where intense competition not only drives down prices but also stimulates after-sales service and quick-turnaround stock replenishment. Zhengzhou in Henan represents a different model altogether through a cash-focused, direct-to-driver approach where high-brand recognition is paired with wholesale pricing and tightened credit terms. The Liu Lai Zhan concept has reshaped how some buyers obtain premium brands in this environment, with direct routes from distributors delivered without the frills of typical middleman channels. And in Nanning, Guangxi, the scale and infrastructure of the market reinforce a competitive edge that serves both South China and the Southwest with robust stock levels and reliable logistics for bulk orders.

Accepting the diversity of these hubs helps a buyer craft a sourcing approach that matches operational realities. Large fleets with broad rotation catalogs benefit from Zhejiang’s scale, where supplier concentration can translate into shorter inventory cycles and consistent access to popular sizes and tread patterns. Regional hubs in Guangzhou and the central belt offer advantages when proximity to specific regional fleets matters or when the supply chain requires a tighter, locally attuned service model. In the north, Harbin and Tangshan deliver practical value for fleets that must reconcile price with the realities of longer winter seasons and heavy demand cycles. The Anqing and Zhengzhou clusters remind buyers that wholesale markets are not monolithic; they host specialized economies within the broader national network. For a buyer, the strategic takeaway is to map fleet needs against regional profiles. The goal is not merely to buy tires but to optimize procurement through synchronization of stock, price discovery, and delivery reliability across multiple trading floors.

The practical implications extend to how buyers conduct due diligence. A disciplined approach begins with confirming stock depth and turnover rates in the chosen hub. Online marketplaces and direct supplier channels can supplement in-person visits, but wholesale buyers should treat the physical market as a primary source of truth for tire quality, construction, and compatibility. Quality control remains essential; even in a dense market, the volume of products can mask inconsistencies if proper checks are not performed. Buyers should seek to verify manufacturing dates, tread wear histories, and the presence of any recapped stock where applicable. A robust inspection mindset reduces the risk of receiving tires that fail prematurely or perform outside the expected range for the fleet’s operating conditions. In practice, this means sample testing and a clear process for handling discrepancies with suppliers—conditions that stockholders often honor when there is predictable bulk demand and reputational risk tied to the hub’s overall reputation.

Another practical thread runs through the wholesale tapestry: payment terms and risk management. Local markets sometimes operate with flexible arrangements that accommodate large orders and tight cash flows. Yet, as with any wholesale market, buyers should insist on clear terms for returns, warranties, and after-sales service. Negotiation angles may include volume-based discounts, staged payments aligned with delivery milestones, or bundled logistics arrangements that consolidate multiple SKUs into a single shipment. The objective is to convert bulk purchase into a reliable and repeatable replenishment cycle, minimizing downtime for the fleet and reducing the administrative burden associated with large orders.

For teams that navigate cross-border or cross-region logistics, the regulatory and documentation landscape becomes increasingly relevant. To readers exploring cross-border procurement considerations, there is value in engaging with resources that address the regulatory interface between tire supply chains and fleet operations. A practical touchpoint is to explore events and discussions that shed light on how authorities and industry bodies manage cross-border movements, tariffs, and compliance protocols. This kind of knowledge can prevent delays and help fleets maintain steady cycles of maintenance and replacement. For readers curious about these dynamics, a concise overview is available at the TCAS cross-border regulatory issues event, which provides context for how wholesale buyers can align sourcing practices with evolving regulatory landscapes. TCAS cross-border regulatory issues event

As a closing reflection, the wholesale tire markets across China illuminate a deliberate design: a national network that supports varied fleet profiles with different economic priorities. The Zhejiang hub excels in scale and breadth, the Guangzhou markets provide regional intensity and logistical proximity, and central hubs such as Wuhan deliver professional services and stable stock for critical maintenance windows. The regional clusters—Anqing, Harbin, Tangshan, Zhengzhou, and Nanning—offer specialized paths for particular cost structures or business models, from used tire assortments to cash-based premium-brand channels. This mosaic does not merely reflect commerce; it mirrors the strategic choices a fleet manager makes when balancing upfront cost, total cost of ownership, lead times, and risk exposure. The story of buying wholesale tires in China, then, is a story of aligning operational tempo with the right market mix—leveraging the strengths of each hub to sustain a fleet that must perform reliably, season after season, across diverse geographies and weather patterns. In effect, the wholesale tire market serves as a dynamic ecosystem where scale, regional specialization, and service depth come together to shape the long-term health of a broader logistics operation. The result is a more resilient procurement framework that can adapt to shifting demand, regulatory developments, and the evolving needs of fleets large and small.

External resource: https://www.bts.gov

Regional Corridors of Supply: How Wholesale Tire Hubs Shape Buying for Commercial Fleets

The wholesale procurement of commercial truck tires unfolds through a network of regional hubs that connect global manufacturing with domestic fleets. In today’s market, the most dependable suppliers are those that can translate international production ambitions into timely, cost-effective freight for fleets that depend on reliability. The hub concept is not a mere storage arrangement; it is a living logistics strategy. Inland centers with robust warehousing, transport corridors, and streamlined customs interfaces become the nerve centers for bulk tire purchases, repair and retread programs, and consistent access to high-performance tire lines. In the United States, for example, the strategic value of hubs in Texas, California, and Illinois lies less in the meters of shelf space and more in the speed with which they convert overseas production into on-the-road service. These hubs leverage their central geographic positions and expansive logistics ecosystems to shorten lead times, rebalance inventories, and synchronize procurement with maintenance cycles across large fleets. The result is a hybrid model in which international sourcing is married to domestic warehousing, enabling distributors to hold cost-competitive stock while maintaining strict safety and quality standards.

This hybrid model rests on clear regulatory pathways and rigorous quality checks. Tires intended for Class 6 through Class 8 applications must meet safety and performance benchmarks that are monitored by federal authorities and accredited third-party labs. In practice, this translates to warehouses that double as quality-control checkpoints. Inspectors review tread depth, bead integrity, and load and speed ratings before a shipment is deemed ready for distribution. The emphasis on compliance is not merely bureaucratic; it reduces the risk of returns, recalls, and warranty disputes that can disrupt a fleet’s budget cycle. It also helps buyers avoid the expensive cycle of overstocking outdated stock or chasing sporadic supply during peak seasons. A well-run hub network lowers carrying costs and stabilizes pricing by smoothing procurement across volatile market windows, a feature that resonates with fleet managers charged with controlling total cost of ownership.

The ongoing integration of overseas production into U.S. distribution illustrates how regional hubs function as convergence points for multiple supply streams. A recent expansion by a prominent wholesale channel broadened the tire lineup available through its network, including a line manufactured abroad and routed through established regional centers. This development demonstrates how overseas production can flow into domestic logistics streams with minimal disruption, provided the partners maintain consistent product specifications, compliant labeling, and reliable freight coordination. For buyers, the implication is straightforward: a diversified sourcing mix—combining domestic warehousing with direct-from-factory imports—can sustain competitive pricing without compromising performance or safety. The hub system, then, is not a stopgap; it is a deliberate architecture for scalable, predictable procurement that can weather fluctuations in foreign exchange, freight rates, and seasonal demand.

Beyond the United States, Europe remains a pivotal source region for both new and retreaded tires. Markets in Germany, France, and the Netherlands have refined recovery and inspection ecosystems that leverage automated tread-depth assessment, structural integrity checks, and standardized usability assessments aligned with international classifications. The emphasis on precision here is not limited to the product’s initial state; it informs the entire lifecycle of tire management as tires travel through redistribution hubs that serve a wide swath of markets, including emerging regions in Africa, the Middle East, and Southeast Asia. Automated inspection technologies shorten cycle times and reduce human error, enabling wholesalers to present fleets with tires that meet consistent performance criteria regardless of origin. The European model also underscores a broader logistics principle: proximity to adjacent markets can transform a regional hub into a continental gateway, where value is created not solely by price but by the ability to certify, stage, and re-export tires with speed and reliability.

West Africa, for its part, has evolved into a redistribution node, with gateway economies such as those along the Gulf of Guinea offering flexible customs arrangements and proximity to high-demand corridors. In these markets, the emphasis shifts toward containerized bulk shipments—typically consolidated into 20-foot or 40-foot containers and baled for compact transport. The strategic advantage for buyers in North America and Europe lies in the ability to leverage these gateways for reallocation toward Africa, the Middle East, or Southeast Asia, depending on regional demand and regulatory alignment. This redistribution dynamic is a reminder that wholesale tire purchasing is not a one-way street from factory to fleet; it is a circular, multi-port system in which tires circulate through regional hubs, opportunistically meeting changing demand patterns across continents.

For fleet operators and tire distributors, the decision to source through regional hubs hinges on several practical considerations. First is inventory velocity. Hubs that maintain broad stock for standard sizes used by heavy-duty trucks—such as large-bore, high-load variants that fit Class 6–8 axles—help fleets minimize downtime during replacement cycles. Stock versatility matters as well. A robust hub will offer a spectrum of sizes and tread patterns to accommodate regional road conditions, climate variations, and operator preferences. Second is regulatory clarity and traceability. Buyers seek tires with transparent labeling that aligns with local regulations, including load ratings, speed ratings, and compliance documentation. When a hub can provide this information quickly, it reduces procurement risk and accelerates the approval process for maintenance teams.

A critical dimension of hub-based sourcing is the ability to balance price with quality. The same regional network that supports fast delivery can also negotiate favorable terms with suppliers who meet strict safety and performance standards. This balance often requires a disciplined approach to supplier verification, sample testing, and warranty alignment. In practice, buyers will rotate through a short list of trusted suppliers who have demonstrated consistent performance, even as the hub expands its catalog to include overseas production. The benefit is twofold: procurement teams gain price stability from long-term contracts and fleet managers gain assurance that replacements will perform as expected under demanding operating conditions. The hub model also supports warranty and after-sales services, ensuring that when a tire fails, the supply chain can react decisively with minimal disruption to service schedules.

Online channels and digital marketplaces have become an increasingly important instrument in this ecosystem. Platforms that connect buyers with manufacturers offer product specifications, load and speed ratings, and certification data in a centralized, auditable format. They enable buyers to compare options across suppliers, confirm the availability of full-container-load quantities, and verify the legitimacy of the supplier through real-time dashboards. These tools complement the offline strength of regional hubs by expanding access to a broader spectrum of manufacturers while preserving the quality controls that define a reliable wholesale operation. Crucially, buyers should demand clear sidewall labeling samples and documentation in English to facilitate cross-border compliance and maintenance planning. The digital layer not only accelerates procurement but also enhances risk management by providing traceability throughout the supply chain.

As buyers navigate this expansive landscape, a practical approach emerges. Start with a clear understanding of fleet needs, including typical load profiles, climate exposure, and service intervals. Then map a sourcing strategy that leverages regional hubs for core stock while reserving the option to import selectively from overseas production when pricing or capacity signals justify the move. This strategy requires disciplined inventory planning, with thresholds set for lead times, safety stock, and obsolescence risk. It also calls for rigorous supplier due diligence, including verification of manufacturing capabilities, quality-control protocols, and on-time delivery histories. A well-structured procurement plan will specify the preferred channels for each tire segment, align testing procedures with maintenance standards, and articulate a governance framework for approving substitutions or volume concessions if demand shifts unexpectedly.

Within this framework, the importance of a reliable, diverse distribution network becomes evident. The hub system reduces single-point failure risk by distributing sourcing and storage across multiple regional centers. It also improves responsiveness to road conditions, fuel prices, and regulatory changes. When a fleet needs tires quickly after a blowout or puncture incident, the proximity of a regional hub can be the difference between delayed service and a prompt tire replacement that keeps the schedule intact. In addition, the ability to layer domestic stock with international imports creates resilience against market volatility. A hub network that can adjust to currency swings or freight-rate fluctuations protects the bottom line while maintaining consistent service levels for operators that depend on predictable maintenance planning.

The global dimension of wholesale tire procurement continues to evolve with the rise of direct-from-manufacturer and marketplace models. Buyers increasingly expect to access a broad range of manufacturers through direct channels, including marketplaces that provide detailed product information, certification data, and sidewall labeling samples in English. This transparency is essential for verifying performance attributes and ensuring that tires meet the precise specifications required by the fleet. It also supports a more dynamic procurement approach, where buyers can place orders for custom specifications or adjust orders in response to changing utilization patterns. As this global-to-local flow intensifies, buyers should pay attention to the end-to-end logistics that connect the factory, the regional hub, and the fleet. Each link in this chain can influence lead times, warranty terms, and after-sales support.

For readers seeking additional market context, a case study of market dynamics outside the United States illustrates how wholesale hubs adapt to regional realities. European hubs, with their advanced inspection regimes, demonstrate how automation can shorten inspection cycles without compromising safety. West African gateways illustrate how flexible customs and containerized shipping support efficient redistribution to high-demand corridors. These examples reinforce a broader lesson: the most effective wholesale tire strategies treat hubs as active, intelligent interfaces rather than static warehouses. They anticipate demand, orchestrate cross-border flows, and maintain compliance as a continuous discipline.

In this environment, buyers also explore digital procurement channels that connect them to global manufacturers. Platforms that offer direct access to tires with comprehensive technical data, certification documentation, and English labeling samples empower buyers to validate performance claims before committing to large orders. Such platforms can streamline the due-diligence process, reducing the time spent on supplier vetting while expanding the range of options available to a regional hub network. The result is a procurement ecosystem that blends the reliability of established regional hubs with the breadth of global manufacturing options, enabling fleets to optimize both cost and performance.

To anchor these observations in a practical takeaway, consider the following guiding questions when evaluating wholesale tire options: What is the lead time from order to delivery under typical peak demand? How robust is the hub network in terms of regional coverage and contingency planning for emergency replacements? What traceability and labeling standards does the supplier provide, and how easily can fleets verify compliance on arrival? Are there favorable terms for warranty coverage, return policies, and service support across the network? How flexible is the platform in accommodating custom orders, retread programs, and tire recycling or retreading partnerships? A disciplined approach to answering these questions helps fleets align procurement with maintenance planning, logistics capabilities, and financial objectives.

This broader perspective on regional wholesale hubs ties back to the core objective of the article: identifying where to buy commercial truck tires wholesale in a way that blends cost efficiency, reliability, and regulatory compliance. The regional hub model offers a robust framework for achieving scale without sacrificing performance. By leveraging inland centers as distribution and inspection nodes, fleets can manage inventory and minimize downtime. By embracing European and other international supply dynamics, hubs can secure access to a wider array of tire types and production sources while preserving quality control and safety benchmarks. And by integrating digital marketplaces with traditional distribution networks, buyers can enhance transparency, speed, and competitiveness in a market where demand fluctuates with fuel prices, regulatory developments, and global trade flows.

Internal link for further context on market dynamics: Excess Capacity in the Trucking Market Insights.

For readers seeking additional external context, a comprehensive resource on global tire manufacturing and sourcing can be explored here: Alibaba Truck Tires.

Direct-from-the-Factory: Sourcing Wholesale Commercial Truck Tires from Leading Manufacturers

Direct-from-the-Factory: Sourcing wholesale commercial truck tires from leading manufacturers

Sourcing wholesale tires for a fleet or a tire program is less about chasing the lowest price than it is about unlocking a reliable, scalable supply chain. The path from producer to distributor or fleet manager is a spectrum of choices, but the strongest options consistently begin at the factory floor. In the global market for heavy-duty tires, China stands out as a production and export core. Its vast network of tire plants and associated support industries creates a uniquely efficient conduit for bulk purchases, where scale, consistency, and long-term partnerships can translate into meaningful savings and steadier operations for buyers who need tens or hundreds of tires each season. The logic of direct sourcing from manufacturers is simple in principle: fewer intermediaries, clearer accountability, and the chance to tailor agreements to a fleet’s specific demands. In practice, achieving that alignment requires an understanding of where production occurs, how it is organized, and what buyers must do to verify quality and continuity across an extended lifecycle of tires.

At the heart of this wholesale ecosystem lies Shandong Province, a region often described as the engine room of tire production. No single province in China can claim the same breadth of capacity or the same concentration of specialized facilities as Shandong. The province houses hundreds of tire factories, with Qingdao and Yantai serving as international export hubs. These cities have developed deeply integrated supply chains that span raw rubber processing, wire bead production, and the advanced molding technologies that distinguish modern radial truck tires. For buyers, the payoff is not merely cheaper raw materials but a network capable of sustaining large orders with relatively short lead times and predictable throughput. The export infrastructure around these cities is robust, featuring port facilities and logistical channels designed to move goods efficiently to East Asia, the Middle East, Europe, and the Americas. In terms of cost dynamics, the scale and efficiency of Shandong producers often translate into significant advantages, with credible reports of international buyers achieving double-digit percentage reductions on landed costs when they commit to a direct sourcing model that emphasizes repeat orders, stable quality, and transparent QC processes.

Within Shandong, Qingdao and Yantai exemplify how factories can transition from production lines to export pipelines. Qingdao, in particular, has earned recognition for firms that align with global standards and maintain a cadence of certification and testing that reassures international buyers. Vertically integrated supply chains are a hallmark here; manufacturers commonly manage rubber compounding, wire belt preparation, tread compound processing, and final molding under one umbrella, which streamlines quality control and accelerates response times to market shifts. The interplay of port proximity, standardized testing regimes, and ISO-adopted practices creates a credible, replicable model for wholesale procurement. For buyers, the implication is straightforward: when a supplier in Qingdao or nearby ports can demonstrate traceable production steps, certified materials, and consistent performance across multiple tire lines, it becomes easier to justify long-term contracts that lock in pricing, ensure supply, and reduce the operational risk that comes with frequent stockouts or delays.

Another provincial cluster worth watching is Jiangsu, a region notable for its automation and the emphasis it places on smart manufacturing. Jiangsu’s tire manufacturers frequently leverage advanced robotics, real-time QC analytics, and lean production practices that reduce cycle times and improve defect detection. This combination translates into tighter capacity control and more predictable order fulfillment, two metrics that directly affect wholesale arrangements where buyers commit to multi-month purchase calendars. The Jiangsu ecosystem complements the Shandong hub by offering an alternative mix of capabilities—particularly for buyers seeking different product lines, performance characteristics, or price tiers—without the need to chase a supplier in distant markets. The consequence for wholesale buyers is a broader pool of scalable partners to choose from, each able to meet specific performance benchmarks, lead times, and regional logistics constraints.

Beyond the coastal production corridors, regional centers like Ningxia Hui Autonomous Region have carved out a niche by specializing in certain segments of tire technology. Ningxia’s emphasis on environmentally conscious rubber formulations and high-load, radial designs reflects a growing segmentation within the industry: buyers increasingly value suppliers who can deliver targeted capabilities alongside standard highway tires. While Ningxia’s scale may be smaller than Shandong’s, the strategic value comes from diversity in supply options and the ability to source tires that meet unique regulatory or application requirements. This diversification matters when a fleet needs tires that perform reliably under particular duty cycles, temperatures, or road conditions. For wholesale buyers, the regional variety means more room to shape a sourcing strategy that aligns with fleet operations, maintenance cycles, and total cost of ownership over the life of a tire program.

A concrete exemplar within this broader landscape is Qingdao Aufine Tyre Co., Ltd., a company frequently cited by international buyers for its sustained focus on radial truck tires and passenger tires. Aufine’s footprint reflects the larger advantages of direct factory sourcing: advanced production equipment, rigorous internal testing, and a portfolio backed by multiple international certifications. The company’s approach—rooted in high-standard manufacturing and continuous process improvement—helps buyers achieve predictable performance and reliable supply across diverse markets. For wholesale buyers, engaging with a manufacturer like Aufine provides not only a clear line of accountability but also the potential for customized terms that accommodate seasonal demand spikes, fleet refresh cycles, and regional distribution nuances. Certification and quality assurance, including widely recognized standards, further reduce the risk of receiving subpar inventory and simplify ongoing vendor management as part of a broader procurement ecosystem.

The practical pathway to direct sourcing from factories remains nuanced. Digital marketplaces such as major B2B platforms provide a gateway to direct suppliers, but successful procurement hinges on more than price quotes and catalog listings. A robust due-diligence framework is non-negotiable. Buyers must assess each supplier’s delivery reliability, quality control regime, and the ability to sustain long-term partnerships. The governance around supplier selection should extend beyond initial sample tires to include a track record of on-time deliveries, consistent defect rates, and the capability to scale production in line with forecasted orders. In a direct-sourcing model, the relationship is not a one-off transaction but a long-term collaboration that entails joint planning, shared forecasts, and continuous improvement initiatives across production, logistics, and quality assurance. The value proposition of direct sourcing, therefore, lies in the cumulative effect of reliable delivery, quality consistency, and the strategic alignment of production capabilities with a buyer’s evolving tire needs.

For buyers exploring this path, it is also essential to recognize how regional hubs interlock with the broader supply chain. Anhui and Hebei, for instance, contribute to the nationwide network of wholesale centers by providing additional capacity, specialized inputs, and localized distribution nodes. Anhui’s manufacturing base supports mold tooling, tread compound development, and related processing steps that feed into the larger export pipeline. Hebei, with its own suite of steel-related and assembly capabilities, contributes critical components and sub-assemblies that affect lead times and cost structures. The presence of multiple regional hubs means buyers can adopt a diversified supplier base, balancing risk across geographies while preserving bulk-buy advantages. A diversified approach helps mitigate the impact of localized disruptions, currency fluctuations, or transport bottlenecks, ensuring that a tire program remains within planned budgets and schedules.

In practice, wholesale procurement from direct manufacturers is about translating capability into continuity. A buyer must insist on a clear, enforceable framework that covers pricing, lead times, minimum order quantities, storage obligations, and post-delivery support. The logistical choreography is equally important: incoterms, freight terms, minimum logistics charges, and port handling fees all feed into landed cost calculations. A well-structured agreement will also specify quality control expectations at multiple stages—raw material receipts, in-process inspections, final product sampling, and third-party verification when necessary. The goal is to establish a transparent, auditable chain of custody for tires as they move from production lines to regional distribution centers and, ultimately, onto the wheels of a fleet. In an industry where a few missing containers can ripple into fleet outages, clarity on who bears risk and when, who approves deviations, and how escalations are resolved becomes as important as the tires themselves.

The decision to pursue direct-from-factory sourcing often intersects with broader market dynamics. Buyers must stay attuned to trucking-market rhythms, regulatory changes, and shifts in fleet acquisition strategies. A recent synthesis of industry indicators points to a period when capacity constraints, energy costs, and demand cycles influence trailer orders and spare parts replenishment. Those macro trends reverberate through tire procurement, highlighting the value of a responsive supplier network and a framework that makes it safe to scale purchase volumes up or down without triggering prohibitive price volatility. The connection between macro trends and tire sourcing is not abstract; it translates into practical decisions about how aggressively to commit to long-term supplier relationships, how to structure price protections, and how to build a supply buffer that can weather seasonal waves and unexpected demand spikes. For wholesale buyers, the integration of market intelligence with a disciplined supplier program is a cornerstone of resilience.

Embedding this approach into everyday practice means treating direct manufacturers as strategic partners rather than one-off vendors. The most effective buyers invest in early conversations with factory producers, sharing forecasts and service expectations while requesting detailed capacity plans and quality-control protocols. They pursue pilots that confirm performance under a range of operating conditions and demand that the supplier document process controls, traceability, and corrective action procedures. Such steps may require additional time upfront, but they yield downstream dividends in the form of improved lead times, fewer quality issues, and steadier supply during market shocks. A pivotal element in this journey is clarity about the role of digital channels in connecting buyers with manufacturers. Digital platforms can facilitate initial screening and supplier discovery, yet the ultimate partnership hinges on face-to-face alignment of capabilities, culture, and performance expectations. In practice, the best wholesale tire programs emerge when buyers blend the speed and reach of online sourcing with the rigor of on-site supplier audits and end-to-end quality assurance practices.

For readers exploring the practicalities of this topic, the wider discussion in industry literature illuminates how macro trends intersect with procurement choices. A specific thread worth examining is how trucking-market dynamics influence wholesale tire demand and supplier strategies. The broader point is that procurement success in this space rests on more than pricing; it depends on the ability to forecast demand, to secure reliable capacity, and to cultivate relationships that support continuous improvement in both product and service quality. The direct-sourcing paradigm, when executed with careful planning and disciplined risk management, can yield a resilient tire supply that aligns with a fleet’s operational tempo and financial objectives. The aim is a stable, cost-effective tire program that travels from factory floors—through regional hubs and logistics nodes—into the hands of maintenance teams and fleet managers who need dependable performance on every mile.

As buyers navigate these options, a practical touchstone is the balance between breadth and depth. Broadly, direct manufacturers in provinces like Shandong and Jiangsu offer breadth—high production volumes, multiple tire lines, diversified certifications, and expansive geographic reach. Deeply, these suppliers provide depth—technical expertise in compound formulations, specialized tread designs for specific duty cycles, and capacity to customize terms for large, long-term contracts. The most successful wholesale programs stitch together this breadth and depth by selecting a core set of trusted factories, maintaining a structured supplier-review cadence, and layering in strategic backup sources to mitigate risk. In the end, wholesale tire procurement is as much about relationship management and process discipline as it is about the tires themselves. The direct-from-factory route, when navigated with precision, creates a procurement dynamic that translates into tangible fleet reliability, better maintenance planning, and clearer cost governance across the lifecycle of every tire.

For readers who wish to explore concrete supplier profiles and to begin forming direct relationships, the landscape offers credible starting points. While the journey from inquiry to shipment involves verification and negotiation, the payoff is a more predictable supply of tires that fit the fleet’s duty cycle, operating environment, and budgetary constraints. The combination of regional manufacturing hubs, diversified capabilities, and a culture of certification and testing creates a compelling case for direct sourcing as a core pillar of wholesale procurement. It is a pathway that aligns with broader industry shifts toward resilience, efficiency, and strategic supplier partnerships—principles that underwrite sustainable tire programs for fleets that rely on consistent mobility and predictable maintenance costs. In practical terms, the route to wholesale direct sourcing begins with identifying a set of reputable manufacturers, validating their capabilities, and developing a forecast-driven purchasing plan that translates into stable price trajectories and assured supply across the coming years.

Internal reference: This perspective aligns with ongoing industry discourse about how macro-level trucking economic trends affect wholesale tire orders and supply chain planning. See related analysis here: trucking-economic-trends-affecting-trailer-orders.

External reference: For a profile of a leading direct supplier in China and an example of the types of certifications and capabilities buyers expect, see the company profile on a major B2B platform. https://www.alibaba.com/company/qingdao-aufine-tyre-co-ltd.html

Where to Source Truck Tires in Volume: Navigating Online Marketplaces and B2B Channels

Finding reliable online channels to buy commercial truck tires in wholesale quantities requires more than a simple search. It calls for a strategic approach to platforms, supplier vetting, product verification, and logistics planning. This chapter walks through the practical considerations and the types of online marketplaces that consistently deliver both scale and quality for fleet managers, distributors, and resellers who need to place large orders and control cost, compliance, and delivery timelines.

Online sourcing for commercial truck tires divides naturally into a few marketplace types, each suited to different sourcing goals. The first are large global B2B marketplaces that aggregate hundreds or thousands of manufacturers and trading houses. These sites offer breadth: multiple tire constructions, tread patterns, sizes, and private-label options appear side-by-side. For a buyer seeking volume discounts and the ability to compare supplier credentials quickly, these platforms are efficient. They typically include supplier verification tools, transaction protection mechanisms, and features that support negotiation on minimum order quantities and customization, such as private-labeling and bespoke tread design.

A second marketplace type concentrates on domestic or nearshore suppliers. For North American buyers, these platforms present an advantage when lead time, import risk, or tariff exposure matters. They list suppliers who can offer domestic inventory or nearby distribution centers, and often include more detailed technical documentation, logistics support, and local warranty or after-sales arrangements. When total landed cost, regulatory compliance, and easier returns are priorities, these channels reduce complexity.

Third are curated global sourcing portals and virtual trade show hosts. These platforms emphasize vetted suppliers and export readiness. They are best when you want a partner rather than a vendor: higher levels of quality control, inspection options, factory audits, and long-term production planning. If your requirement includes private-label production runs or controlled supply partnerships for seasonal demand, these portals help identify suppliers that already export to regulated markets and understand long-term contractual relationships.

Finally, industry-specific marketplaces and distributor networks cater directly to fleets and tire-only resellers. These channels integrate inventory visibility, allow real-time ordering against stock, and sometimes offer integration with fleet management software. For operators managing scheduled tire replacements across many vehicles, this real-time inventory access and integration capability can streamline procurement and fleet uptime.

Whatever channel you pursue, supplier credibility is the central consideration. Look for clear quality documentation such as third-party management system certifications, export records, and customer references from similar markets. Ask for production photos, material certificates, and inspection reports. Many verified suppliers will provide test results and factory inspection reports for the specific tire models you are considering. When possible, arrange a third-party lab test or inspection at a neutral facility to validate claims before committing to a large order.

Sampling remains indispensable. Request sample tires from shortlisted suppliers and run them through your own criteria: static inspection for construction consistency, tread depth and compound feel, bead integrity, and sidewall uniformity. If operational testing is possible, fit samples on vehicles and monitor for noise, handling, heat buildup, and wear characteristics over a defined mileage. Samples protect you from bulk-order surprises and allow you to validate private-label finishing if you plan to rebrand the tires.

Contract terms around minimum order quantities, lead times, and payment milestones differ widely across platform types and suppliers. Global B2B marketplaces often show many suppliers willing to negotiate minimums for large orders, but lead times can extend due to factory scheduling and export logistics. Domestic platforms might offer smaller minimums and faster dispatch but at higher per-unit pricing. For consistent supply, negotiate rolling replenishment contracts rather than one-off orders. Contracts that specify production slots, quality acceptance criteria, and penalties for off-spec shipments help stabilize supply and protect margins.

Logistics considerations are as important as the tire build itself. Shipping large tire volumes demands an awareness of containerization, weight calculations, and pallet configurations. Factor in port handling, inland freight to your distribution points, and potential customs or regulatory inspections. Platforms that facilitate freight forwarding or provide recommended logistics partners can reduce friction, but always verify carrier reliability and insurance coverage for international shipments. For North American buyers, nearshore suppliers or domestic platforms reduce exposure to transoceanic delays and customs complexity.

Warranty and after-sales service can be a deal maker or breaker in wholesale purchases. Clarify warranty scope, claim processes, and who bears the cost of return shipping for defective goods. Reputable suppliers and channel platforms will outline clear procedures and typical claim turnaround times. When you plan to sell under a private label, ensure the supplier’s warranty terms are transferable or that you can establish your own coverage backed by the supplier’s technical support. A defined warranty policy reduces downstream disputes and supports customer confidence.

Payment and transaction security deserve careful handling. Use escrow or trade-protection services where available, and avoid large upfront payments without safeguards. Many large marketplaces provide trade assurance and buyer protection tools that hold funds until shipment milestones are met. For repeat business, establish bank-backed letters of credit or phased payments tied to production and inspection milestones. These instruments protect both buyer and seller and help manage cash flow on high-value orders.

Quality control at scale requires clear sampling plans and inspection checkpoints. Implement pre-shipment inspections that check for dimensional tolerances, uniformity, and marking consistency. Insist that the supplier provide a full packing list, digital photos of the loaded containers, and factory inspection reports. If timelines allow, arrange an independent inspection at the factory before goods depart. These measures reduce the risk of receiving mismatched models, incorrect labeling, or substandard batches that can damage your reputation and cost more to rectify.

Regulatory compliance is often underestimated. Tire imports must meet regional safety standards, labeling requirements, and, in some markets, emissions-related markings. Confirm that the supplier understands the regulatory environment of your target market and can supply the necessary declaration of conformity, performance test reports, and labeling to meet local rules. Platforms that cater to export-ready suppliers typically require proof that manufacturers can meet such compliance hurdles and assist in connecting buyers to suppliers who routinely ship to regulated markets.

Relationship-building with suppliers through online platforms pays dividends. Communicate expectations clearly in writing, document technical specifications, and agree on change control processes for design or compound adjustments. Suppliers that see repeat business are more likely to prioritize your orders and to cooperate on customizing packaging or branding. Long-term partnerships also enable better forecasting and more favorable payment terms over time.

For buyers expanding into new markets or launching private-label lines, consider engaging local agents or consultants who are familiar with platform-specific nuances and cross-border logistics. These professionals can perform factory checks, translate specifications, and manage tariff classification. They often accelerate negotiation and reduce cultural or contractual misunderstandings that can arise in high-stakes wholesale transactions. For cross-border regulatory insights and event-driven networking that can help in vetting partners, see bridging-border-barriers meeting insights.

When it comes to integrating online sourcing into your procurement strategy, map platform strengths to your priorities. Use large B2B marketplaces for supplier discovery, price benchmarking, and initial vetting. Turn to domestic or nearshore platforms when lead time and regulatory simplicity matter. Leverage curated global portals for long-term partnerships and private-label production. And tap industry-specific marketplaces for stock-based purchases and software integration that supports fleet operations.

The digital sourcing landscape continues to evolve, but the fundamentals remain constant: credible documentation, sampling, secure payment terms, logistic clarity, and warranty protection. Approach online platforms with a structured due diligence checklist, and layer in professional inspections and legal protections for major purchases. With disciplined sourcing, online channels can deliver both the scale and the quality needed for commercial truck tire wholesale purchasing.

For a starting point on supplier listings and marketplace features, explore a major global B2B marketplace that aggregates verified manufacturers and supports customization and trade protection: https://www.alibaba.com/trade/search?fsb=y&IndexArea=product_en&CatId=&SearchText=commercial+truck+tires

Final thoughts

In conclusion, sourcing commercial truck tires wholesale involves navigating a variety of key markets and suppliers, regional hubs, and innovative online platforms. By understanding the dynamics of these different purchasing avenues, logistics and freight companies, along with construction and mining enterprises, can optimize their procurement strategies to achieve maximum efficiency and cost-effectiveness. The insights presented in this article equip owners and procurement teams with the knowledge necessary to enhance their fleet operations. Ultimately, the right approach to sourcing tires will ensure fleets remain operational and competitive in today’s demanding marketplace.